Hallo zusammen!

Friday, November 14, 2025. A day for reflection.

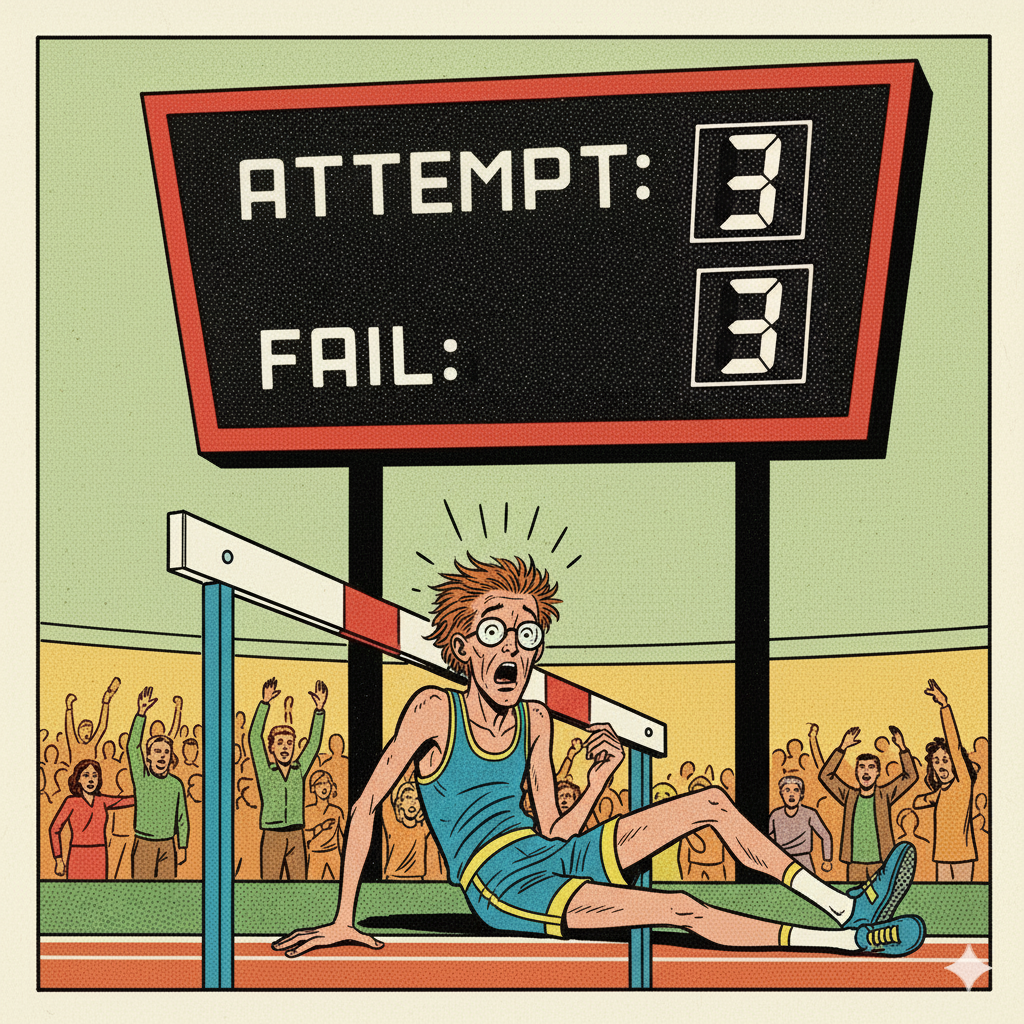

Referring to what I wrote in yesterday’s post (which you can read here: the-lone-traders-watch-third-times-the-charm-cpi-algos-and-the-green-morning-trap-november-13-2025), yesterday was a crucial day. It was the third time this week the market violently tried to decide a direction, with average movements of 5% on each attempt.

Yesterday, the market did exactly the same as in the two previous attempts, but on this occasion, the bears were the winners.

Now I am almost convinced that this cycle reached its climax in the third week of September. A rally back to a new ATH (All-Time High) will be difficult. Not impossible, but very difficult.

My theory, as I’ve been outlining for a few weeks, is that BTC has begun a distribution stage, heading for a gradual correction towards the 200-week Simple Moving Average (SMA).

The SMA 200 Magnet and Market Order

This is not a prediction. It’s simply how prices behave. When the price, in either direction, moves too far from its “normal” (in this case, the line formed by the 200 SMA), this line acts like a magnet, pulling the price back to its base or origin.

I know it might sound very technical, but the market is, like everything in nature, formed by mathematical patterns (Fractals). What makes the market readable are these patterns; it’s how the apparent chaos of the market reveals an underlying order. If you look at the market on a micro level (daily or intraday charts), you’ll see the same patterns repeat over and over, just at a faster pace.

With this, I don’t want to be labeled a bear. Corrections, as I’ve said before, are natural. This is the moment when professionals exchange their positions for liquidity. This same 200 SMA line, just as it attracts, also repels. Professionals know this, and if the price is drawn to it, and the asset is truly “valuable,” professionals will begin a new, quiet accumulation phase there.

Today’s Outlook: Options Expiry

Today, the market opens in negative territory. BTC is on the edge of $96,000, ETH at $3,130, SOL at $140, and BNB at $906.

The main event moving the price today is the expiry of BTC and ETH options.

My advice: Be careful. Expiry days often generate counter-intuitive and unexpected movements, exacerbated by Algo-trading that aims to liquidate positions.

In a market I’ve already described as “RABID,” caution is paramount, especially with leverage.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/