Hallo zusammen!

Markets, as we know, often act in unforeseen ways. This is precisely why I clarify that I don’t attempt to predict anything; I simply articulate what I observe.

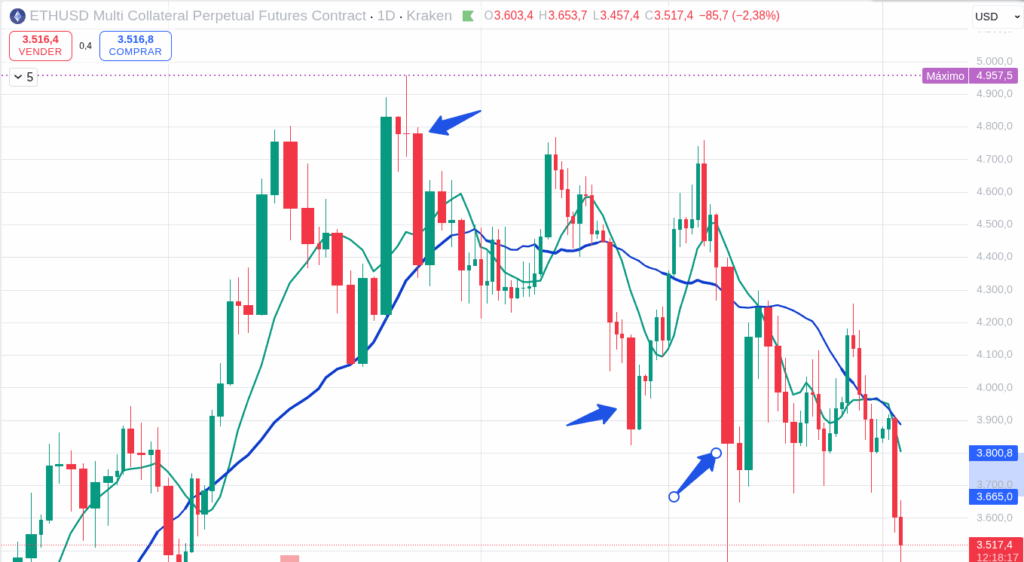

There’s a premise I follow regarding price action: when the crypto market makes a furious, “rabid” move in one direction—like the recent red bars on the daily charts for BTC, ETH, and SOL—it often generates counter-movements of comparable force. I’ve witnessed many convincing moves in one direction be completely negated.

This phenomenon makes me pause and question if we’ve truly entered a sustained downtrend. Generally, a truly powerful and healthy trend generates smoother, more constant movements. You’ll see the 20 and 9 SMAs forming a consistent, gentle line at an angle, perhaps around 45 degrees, and the price tends to bounce softly off the SMA 9 or 8, holding steady.

The current, violent price action, with its sharp drops, suggests something else to me. It makes me lean towards the idea of equally “rabid” bounces—sharp, deceptive rallies—until the market finally commits to a clearer direction. We’re in a period of high volatility, not necessarily a smooth, controlled downtrend.

Where Might This Volatility Lead? The Long View

Despite the short-term choppiness, the longer-term gravitational zones remain valid as potential targets if this correction deepens. These are not exact numbers but rather “zones” where significant support has historically accumulated:

- ETH: I’m watching the weekly SMA 200, which sits in the ~$2,400 – $2,500 zone.

- BTC: A deeper correction could see it target the ~$55,000 – $60,000 zone.

- SOL: For Solana, the ~$100 – $110 zone looms as a major support area.

We can’t predict with certainty that these levels will be reached, or when. But the probability exists, especially given the historical movement patterns of these assets. We’ll be watching closely this week; I believe by Friday, we’ll have more clarity – or perhaps not, as only time will tell.

The Macro Landscape: JOLTS & Lagarde in Focus

Today, Monday, November 4, 2025, has a couple of key events that could influence market sentiment and liquidity, especially for the NYSE, Nasdaq, and of course, crypto.

- Europe (Morning): Christine Lagarde’s Speech (ECB)

- This is an important event for the Euro and overall risk sentiment in the European session. Her comments could influence U.S. futures and, by correlation, tech stocks and crypto.

- United States (NY Session): JOLTS Job Openings (September)

- This is the star data of the day, scheduled for 10:00 AM ET (NYC Time). The Fed closely monitors JOLTS to gauge the tightness of the labor market.

- Stronger-than-expected JOLTS: Implies a “hot” labor market, which could make the Fed maintain a more restrictive policy. This typically puts pressure on the Nasdaq and risk assets like crypto.

- Weaker-than-expected JOLTS: Suggests a cooling labor market, which the market might interpret as “less inflationary pressure.” This usually favors growth/tech stocks and crypto, at least in the short term.

- This is the star data of the day, scheduled for 10:00 AM ET (NYC Time). The Fed closely monitors JOLTS to gauge the tightness of the labor market.

Today is a regular trading day in both the U.S. and Europe; no holidays closing the markets. This means full liquidity and reactions to the incoming data.

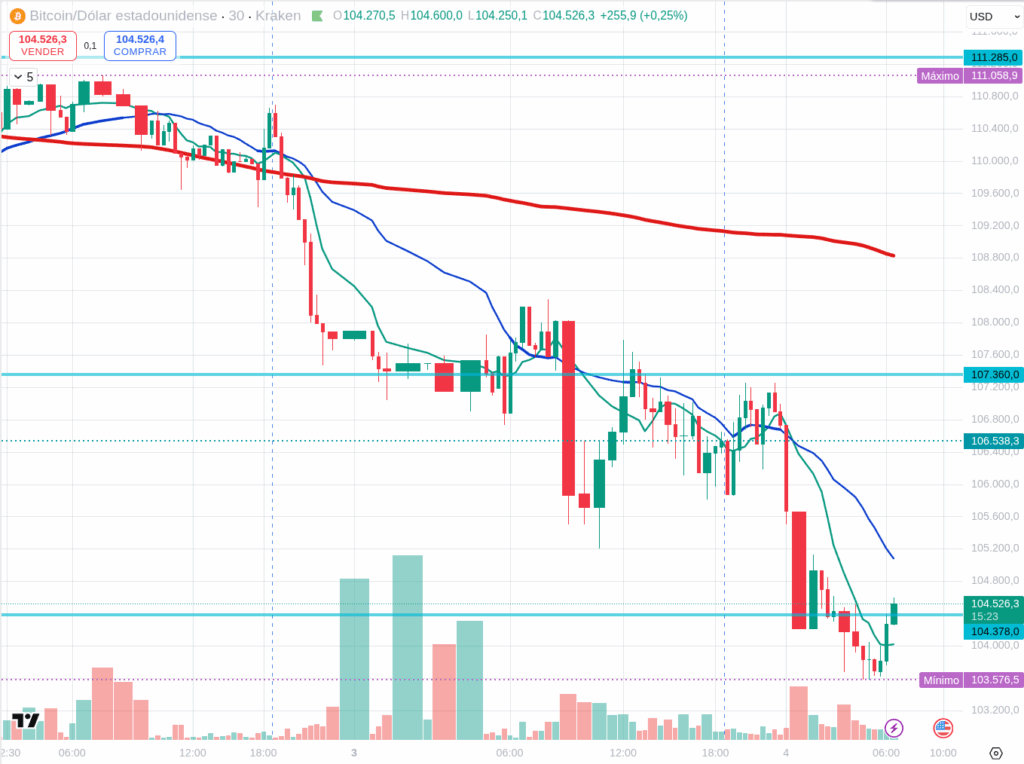

Technical Snapshot: Riding the Waves of Volatility (30-Min Charts)

With the prices currently around BTC ~$104,000, ETH ~$3,500, and SOL ~$161, we’re in a volatile zone. My “Action Price” philosophy isn’t about rigid predictions but about understanding where the buying and selling aggression truly lies.

General Observations on the 30-Minute Charts:

- BTC, ETH, SOL all show aggressive moves downward, pushing them towards their daily lows. This indicates sellers are in control.

- No Clear Bottom Yet: We are seeing prices test critical immediate demand zones, but without clear, strong absorption or reversal patterns (like a strong hammer candle with volume, or a bullish engulfing).

- Overextended, but Not Necessarily Ready for a Smooth Reversal: While some might be technically oversold (especially SOL), this doesn’t guarantee an immediate, sustained bounce. It just means the selling has been intense. We need to see price action confirm a true reversal, not just a temporary relief bounce.

- Moving Averages: The short-term moving averages (like EMA20) are likely below the longer-term ones (EMA50) and pointing downwards across all three, reinforcing the immediate bearish bias. Any bounces should be treated as potential pullbacks within this current downward “rage.”

What about BNB?

And what about BNB? This is one I’m definitely going to start tracking more closely. Trading around $958, it continues to show remarkable resilience and independent strength. While the majors are struggling with sell-offs and grappling with potential downtrends, BNB has consistently defied gravity, demonstrating that the Binance ecosystem remains a powerhouse. Its ability to hold strong, or even make new highs, amidst broader market weakness is a signal worth paying close attention to. It’s an outlier, and outliers often tell us something important about where capital is truly flowing.

My Operational Take:

Given the “rabid” nature of these movements, I’m watching for equally strong, but potentially deceptive, bounces.

- Before JOLTS (10:00 AM ET): I prefer to be light on new risk. The market is already leaning bearish.

- After JOLTS: If the data is interpreted as dovish, I’d look for confirmation of reversal patterns on the 30-minute charts, especially for ETH and SOL, for potential short-term bounce trades. If JOLTS is strong and the market turns “risk-off,” then the downside could accelerate further. In that scenario, chasing bottoms in crypto without clear technical confirmation would be exceptionally risky.

Final Thoughts: Watch the Rage, Don’t Be It

The market today is a battlefield of strong impulses. My focus is on observing these “rabid” moves and avoiding the temptation to fight them head-on. The long-term targets are there, but the short-term path might be full of powerful, counter-intuitive bounces. Patience and clear technical confirmation, especially around the JOLTS release, will be paramount.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/