Hallo zusammen!

It’s Friday, November 7, 2025, and as we head into the weekend, I’ve been reflecting on the market’s bigger picture.

A couple of weeks ago (October 22, to be exact), I published a post about a potential Elliott Wave count I was seeing on the weekly chart for ETH. (You can read that post here: Market analysis october 22 2025. In it, I discussed the probability of ETH seeking its 200-week SMA (around $2,300-$2,500) in what looked like a corrective Wave 4, and how, if that occurred, it could set the stage for a new impulse wave targeting highs above $6,700.

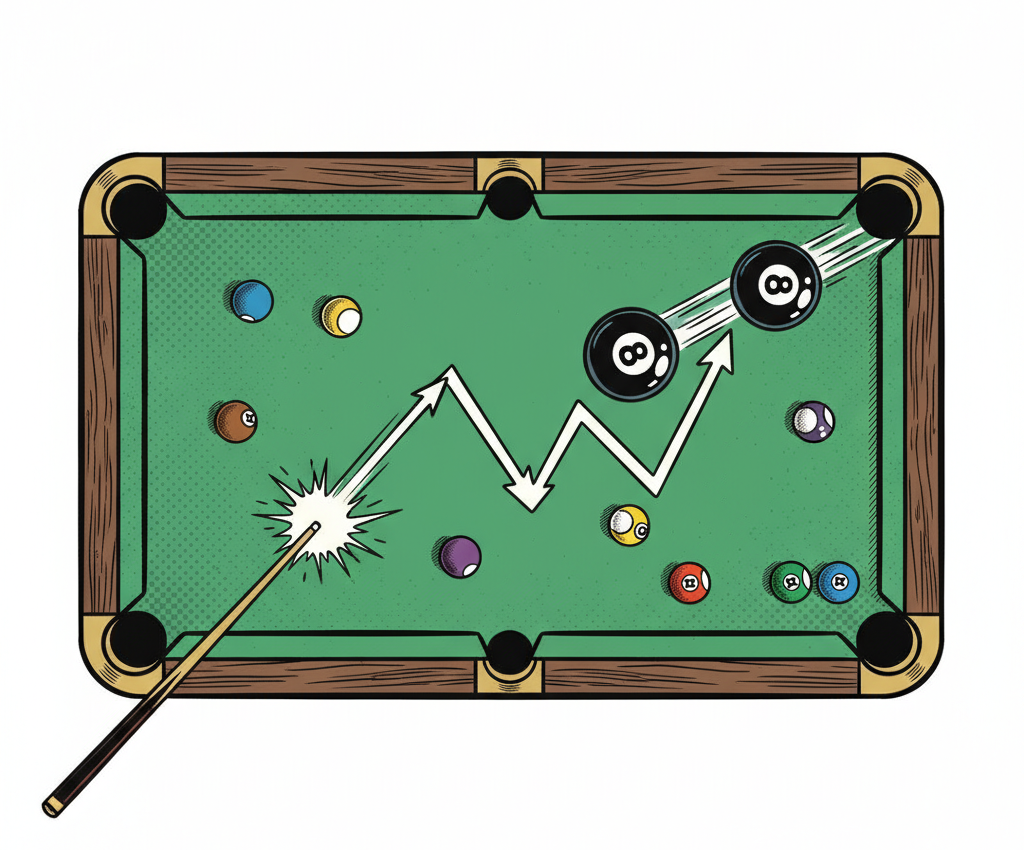

Today, looking at the charts, I’m admittedly less optimistic about the short term, but that long-term thesis remains. ETH is what some call an “eight-ball asset”—much like BTC, but even more “rabid” due to its sensitivity to news. It can travel 50-70% in either direction in a single week, making it incredibly difficult to “HODL” but also presenting incredible opportunities if you can correctly read the momentum.

But that’s the problem, isn’t it? Reading the momentum is extremely difficult. By the time you think you’ve read it, it might be too late, or you fear it’s too late. If you manage to catch it, you’ll make money. But if you try to create the momentum in your mind when it isn’t there, your account will go to the trash. I just wanted to leave that thought with you.

Today, the market wakes up similar to yesterday, with our four main assets showing profound weakness. If you look at the daily charts, they just look ugly. We are clearly starting to print Lower Highs and Lower Lows, and you know what that means.

And yet… the weekly chart doesn’t look that bad. This contradiction is what makes me think this deep correction (perhaps to that $2,300-$2,500 range) is a real possibility, followed by one of those signature face-melting rallies straight to $6,700.

I’ll ask you, my reader (if I even have any!): What do you think?

The Macro Picture: The NFP Showdown

Now, for the immediate-term. Today is NFP (Non-Farm Payrolls) Friday. This is one of the biggest, most volatile-inducing announcements of the month, and it dictates the market’s direction.

- The Event: U.S. Non-Farm Payrolls (NFP), Unemployment Rate, and Average Hourly Earnings.

- The Time: 8:30 AM ET / 14:30 CET (Berlin time).

- The Logic (Simple Version):

- Strong Jobs / High Wages = BAD for Risk Assets (Crypto/Nasdaq): It means the economy is “hot,” which fuels inflation. This gives the FED a reason to stay restrictive (or “hawkish”).

- Weak Jobs / Contained Wages = GOOD for Risk Assets (Crypto/Nasdaq): It means the economy is “cooling,” which tames inflation. This gives the FED a reason to ease policy (or “dovish”).

As always, my rule applies: Wait for the tremor to pass. Do not trade into this number. Let the market react, show its hand, and then find your entry.

Technical Snapshot: Coiling Before the Data (30-Min Charts)

The market is ugly, but it’s also coiling in anticipation of the NFP report. After hitting new lows, we are seeing a fragile attempt to stabilize.

(Current reference prices: BTC ~$100,200, ETH ~$3,240, SOL ~$152.50, BNB ~$939. Remember, these are observations, not predictions or recommendations.)

BTCUSDT (30 min)

Bitcoin, at $100,200, has broken the $101k low and is now trading around a major psychological level.

- Immediate Resistance: ~$101,500 – $102,500

- Pivot / Control Zone: ~$100,000 – $101,000 (The current battleground)

- Key Support: ~$98,500 – $99,500

What to Watch: * The market is in a “decision phase” right at the $100k mark, coiling before the NFP. The technicals (RSI/MACD) are likely neutral, showing a pause in selling but no real buying conviction. * A “good” (weak) NFP report could send BTC bouncing hard off $100k to reclaim $102,500. * A “bad” (strong) NFP report could easily break $100k and send us flushing down to the $98k support.

ETHUSDT (30 min)

Ethereum, at $3,240, has been hit hard and is now deep in corrective territory, far below its recent highs.

- Immediate Resistance: ~$3,300 – $3,350

- Pivot / Control Zone: ~$3,200 – $3,250

- Key Support: ~$3,100 – $3,150

What to Watch: * ETH is showing relative weakness, deeply entrenched in this downtrend. The 30-min chart is likely showing signs of a technical rebound attempting to form, but it’s very fragile. * The NFP data will be the deciding factor. A “good” (weak) NFP report could see ETH snap back towards $3,300. * A “bad” (strong) NFP report would likely send it breaking below $3,200, continuing its path toward that weekly SMA target.

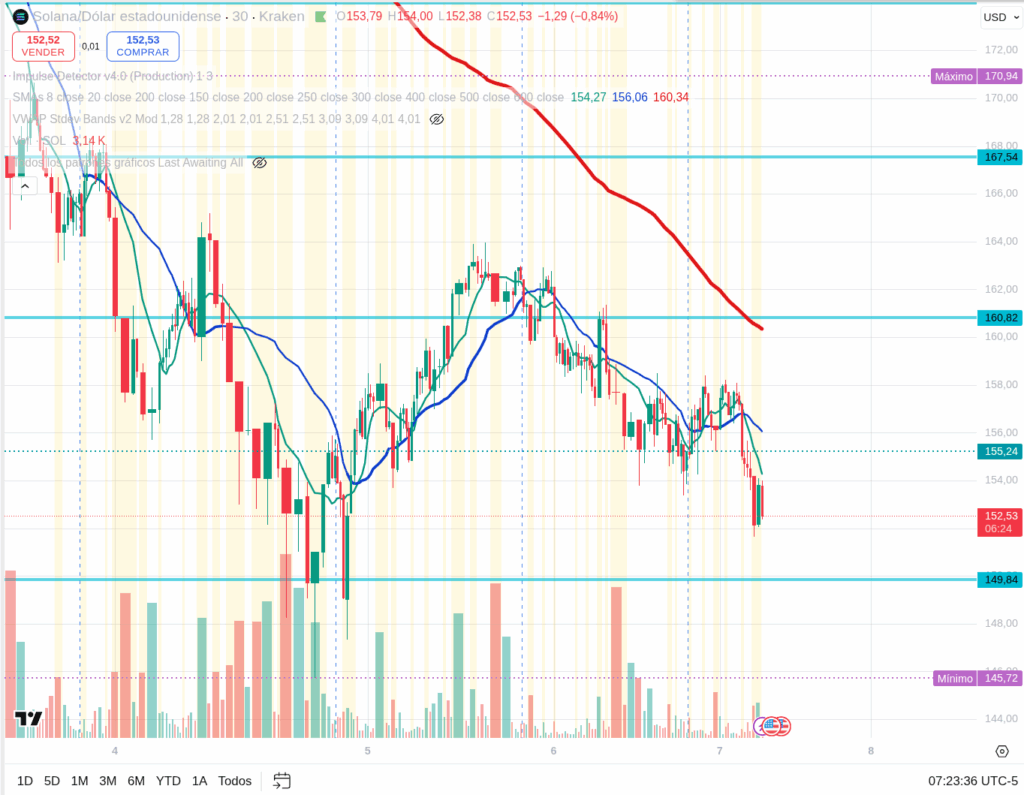

SOLUSDT (30 min)

Solana, at $152.50, has also been crushed, falling back to a major support area.

- Immediate Resistance: ~$158 – $162

- Pivot / Control Zone: ~$150 – $155

- Key Support: ~$145 – $148

What to Watch: * As the high-beta asset, SOL has amplified the market’s downturn. It has likely come out of an “oversold” condition on the 30-min chart and is now coiling. * A “good” (weak) NFP report could cause a violent short-squeeze rally, given how far it has fallen. * A “bad” (strong) NFP report would be devastating for SOL, likely sending it well below $150.

BNBUSDT (30 min)

BNB, at $939, has held up better than SOL but has still broken its recent support structure.

- Immediate Resistance: ~$950 – $960

- Pivot / Control Zone: ~$935 – $945

- Key Support: ~$920 – $930

What to Watch: * BNB is showing some relative strength compared to SOL/ETH, but it’s still in a clear downtrend on this timeframe. * The NFP report will determine if it holds the $935 pivot or breaks down toward the $920 support.

Final Thoughts: The NFP Decides

Today is all about high-stakes, programmed volatility. The market is technically weak (ugly daily charts) but attempting to find a short-term floor as it waits for the NFP report at 8:30 AM ET.

The NFP data will provide the catalyst. My focus remains on the bigger picture—the potential for a deep Wave 4 correction—and my core rule: wait for the tremor to pass. Let the NFP data hit, let the market show its hand, and then look for your opportunity.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/