Hallo zusammen!

Happy Monday, everyone. My view today is that the crypto market, especially Bitcoin (BTC), stands at a very interesting juncture. It’s a moment that demands extreme caution and close observation.

The first week of November closed out in the red. However, since Friday, the price has been held up, even bouncing a little, right off the 50-week Simple Moving Average (SMA), closing just slightly above it. Today, as the European market opens positive, we must wait for the American session to begin. This week is still too young to tell whether these events will propel the price towards new highs – something I’ve expressed doubt about several times lately – or if the price will eventually break this crucial band to revisit the $50,000 mark.

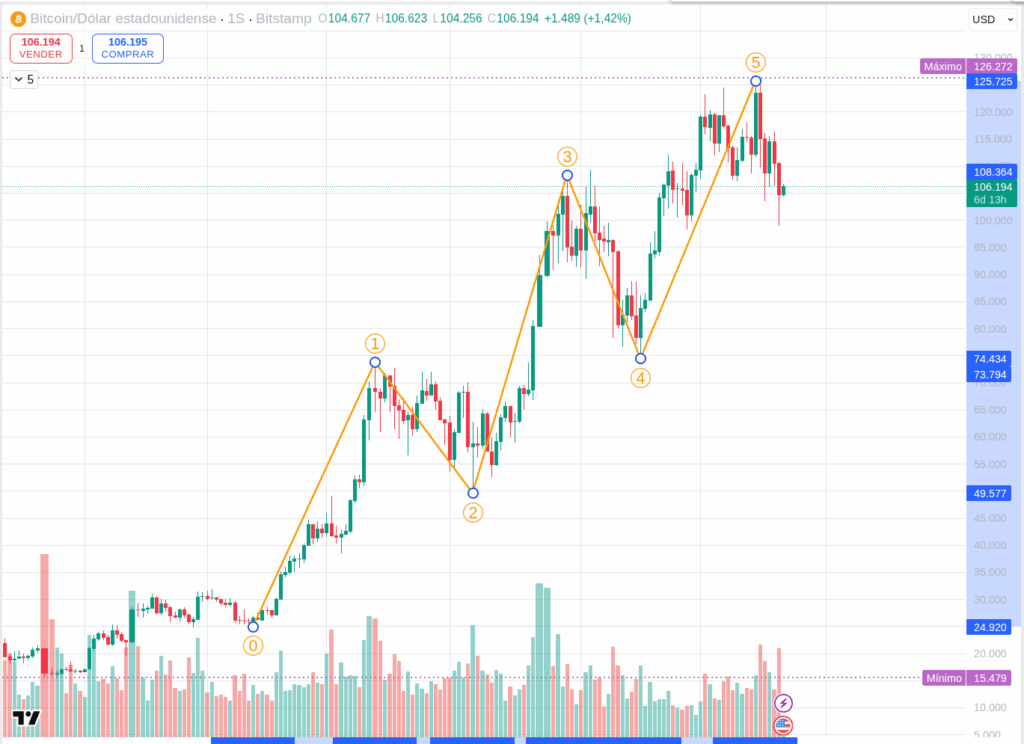

If you observe the weekly chart (and here, I’ve attached a visual to make it clear, even for the most inexperienced eye), it’s evident that since 2023, a powerful Elliott Wave impulse wave has formed.

According to this theory, after the fifth wave of an impulse, a corrective ABC pattern should follow. The exact target of this correction isn’t easily visible yet because Wave “A” is still forming. After “A,” there will be a new rally for Wave “B,” only for the correction to finally end lower at point “C.”

There are many types of corrections—short, deep, moderate—but which type is unfolding, we cannot yet see, nor can we predict. We can only observe.

For my part, I prefer not to be swayed by bullish or bearish cheerleading right now. What I have learned over time, though, is that the chart seems to speak. And when it shows you a real opportunity, it’s as if heavenly bells ring: you see it easily, it calls your attention. You don’t have to search for it; it’s just there.

That’s why today, I won’t talk much about specific prices, supports, or resistances. You already know those. Just a strong reminder to observe the bigger picture.

(Current reference prices: BTC ~$106,200, ETH ~$3,615, SOL ~$168, BNB ~$1,000. Remember, these are observations, not predictions or recommendations.)

The Macro Picture: A Quieter Start to the Week

Today, Monday, November 10, 2025, the macro calendar is relatively light, especially compared to last week’s NFP bombshell.

- Europe (Morning): We’ll see some confidence indexes and activity indicators. These usually set the tone but aren’t market-movers on their own. We’ll also have more speeches from ECB members. Any hawkish (inflation-fighting) comments could pressure European markets, while dovish comments could provide some relief.

- United States (Afternoon): No major economic data releases today. The market will still be digesting last week’s job data and constantly reassessing the Federal Reserve’s interest rate outlook.

In the absence of major data, expect the market to move based on technical flows, existing narratives, and institutional repositioning as the new week begins. Both NYSE and Nasdaq are open as usual today.

Final Thoughts: Listen to the Chart

Today is a day for observation. Bitcoin is at a pivotal point, dancing around its 50-week SMA, and the larger Elliott Wave structure hints at a complex correction ahead. Avoid the noise, and let the chart speak to you. When a real opportunity arises, it will be undeniable.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/