Hallo zusammen!

Let’s analyze where we stand this Tuesday, November 18, 2025.

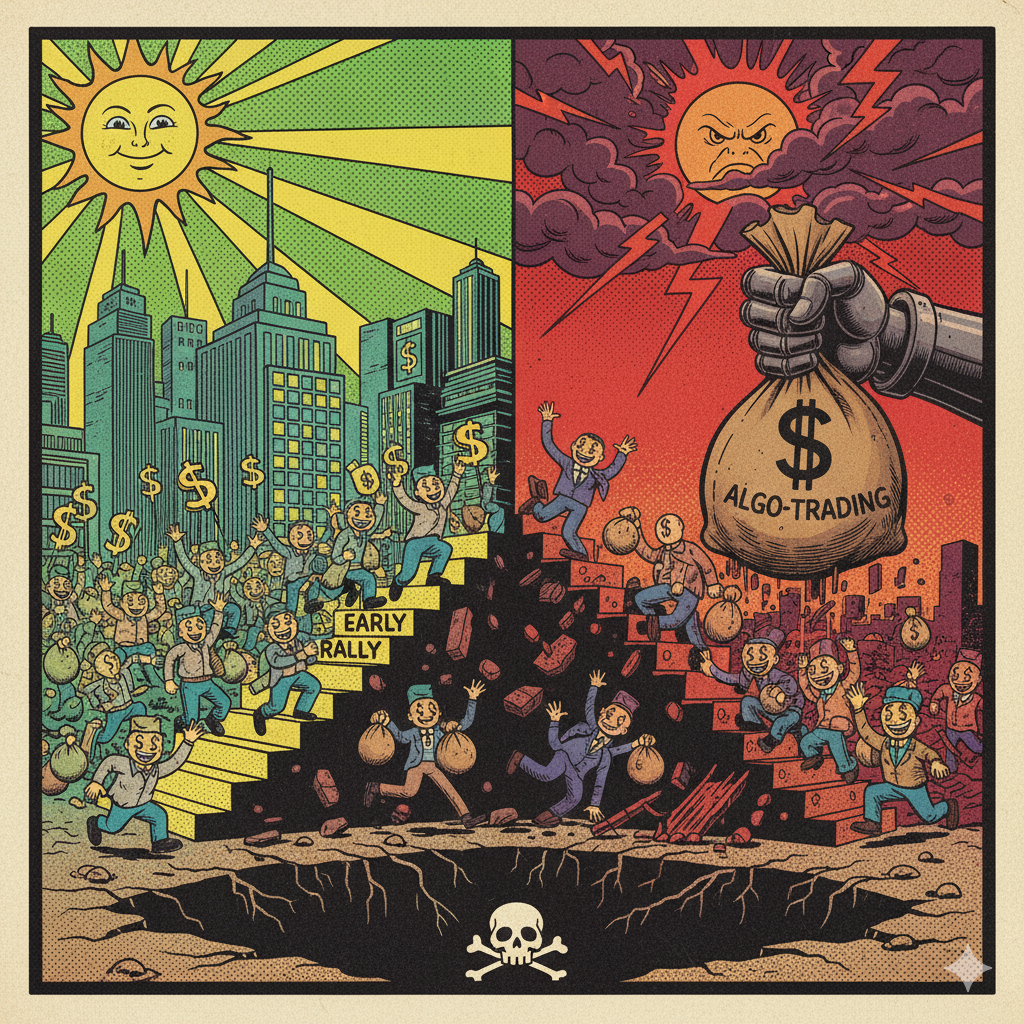

Yesterday, I held back from diving too deep into a suspicion I had, simply to avoid falling into the trap of “predicting.” Instead, I chose to wait. Why? Because I was seeing the exact same pattern that played out three times last week: the price looking like a winner during the Asian and European sessions, only to disintegrate the moment the American market opened.

Yesterday was the confirmation. In the European morning, BTC was up over 1.5%, and ETH rallied nearly +4%. By the end of the day? Both had collapsed, closing down more than -2%.

The Distribution Phase

This behavior corroborates my theory: Bitcoin’s bull cycle has likely peaked (back in September), and we have entered the distribution phase. This is the slow, grinding process that I believe will eventually take the price back to the $50,000 – $60,000 levels.

In the case of Ethereum, I previously eyed a correction to $2,500, but I now think I fell short. It is entirely possible this process drags ETH down to the $2,000 – $2,100 range.

I don’t claim to be a prophet, nor do I have the decades of experience some analysts possess. But I can formulate a theory based on what the chart tells me:

- BTC (Elliot Waves): The impulse wave seems finished. We appear to have started Phase A of an ABC correction. My estimation for Phase A’s target is the $76,000 – $80,000 range. Once there, we might see a bounce (Wave B). Sometimes, Wave B can be deceptive and even surpass the previous high (creating a “bull trap” or Christmas euphoria), but right now, with a clear Rounding Top pattern on the daily chart, I see that as unlikely.

- ETH: The weekly chart shows a clear Double Top at the ATH, and a prominent Rounding Top on the daily. While it’s in an upward channel on the weekly, this structure targets $2,000, well below the weekly SMA 200.

Note: Among the four assets I track, BNB is the only one showing significant relative strength.

I am not Nostradamus. These posts serve a “selfish” function: to analyze the harsh reality of the crypto market so I can see opportunities as they are, not create them in my mind.

The Macro Picture: Housing Data on Deck

Today, Tuesday, November 18, 2025, the macro calendar is relatively lighter than last week, but not empty.

- United States (8:30 AM ET): We have Housing Starts and Building Permits.

- These metrics track the health of the construction sector. While they usually cause less volatility than inflation data, a significant surprise can shift the narrative regarding a potential recession vs. a soft landing.

Markets are open as usual. The focus remains on whether the US open will once again use European liquidity as exit liquidity.

Technical Snapshot: The Bleeding Continues (30-Min Charts)

Prices have dropped significantly. We are now testing major psychological supports.

(Current reference prices: BTC ~$91,100, ETH ~$3,050, SOL ~$137, BNB ~$915. Remember, these are observations, not predictions.)

BTCUSDT (30 min)

Bitcoin has fallen to $91,100, a dangerous level.

- The Setup: We are seeing lower highs and lower lows. The intraday support is the Asian session low.

- What to Watch: If the price breaks the Asian low with volume at the US open, the bearish correction continues. The next psychological floor is $90,000. Any bounce towards yesterday’s US high will likely meet selling pressure (resistance).

ETHUSDT (30 min)

Ethereum is hanging by a thread at $3,050.

- The Setup: ETH acts as a high-beta version of BTC right now. It is weaker and more volatile.

- What to Watch: The $3,000 psychological level is the line in the sand. A clean break below this, followed by a failed retest, confirms the path toward the deeper correction targets ($2,500 and below).

SOLUSDT (30 min)

Solana is at $137, deep in its own correction.

- The Setup: SOL is struggling to find a floor.

- What to Watch: Watch the mid-range of yesterday’s session. If the price stays below it, the bias remains heavily bearish. We are looking for expansion candles downwards if the broad market drops.

BNBUSDT (30 min)

BNB at $915 remains the outlier.

- The Setup: It is showing much more structural strength than the others.

- What to Watch: Look for compression patterns (triangles). While the rest of the market bleeds, BNB is holding. However, if BTC flushes hard, BNB will likely follow eventually, but for now, it is the strongest horse.

Final Thoughts

The pattern is clear: Green mornings are becoming liquidity traps for the US session. Until this dynamic changes, buying the morning strength is a high-risk strategy. I’ll be watching the $90k level on BTC and $3k on ETH very closely today.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/