Hallo zusammen!

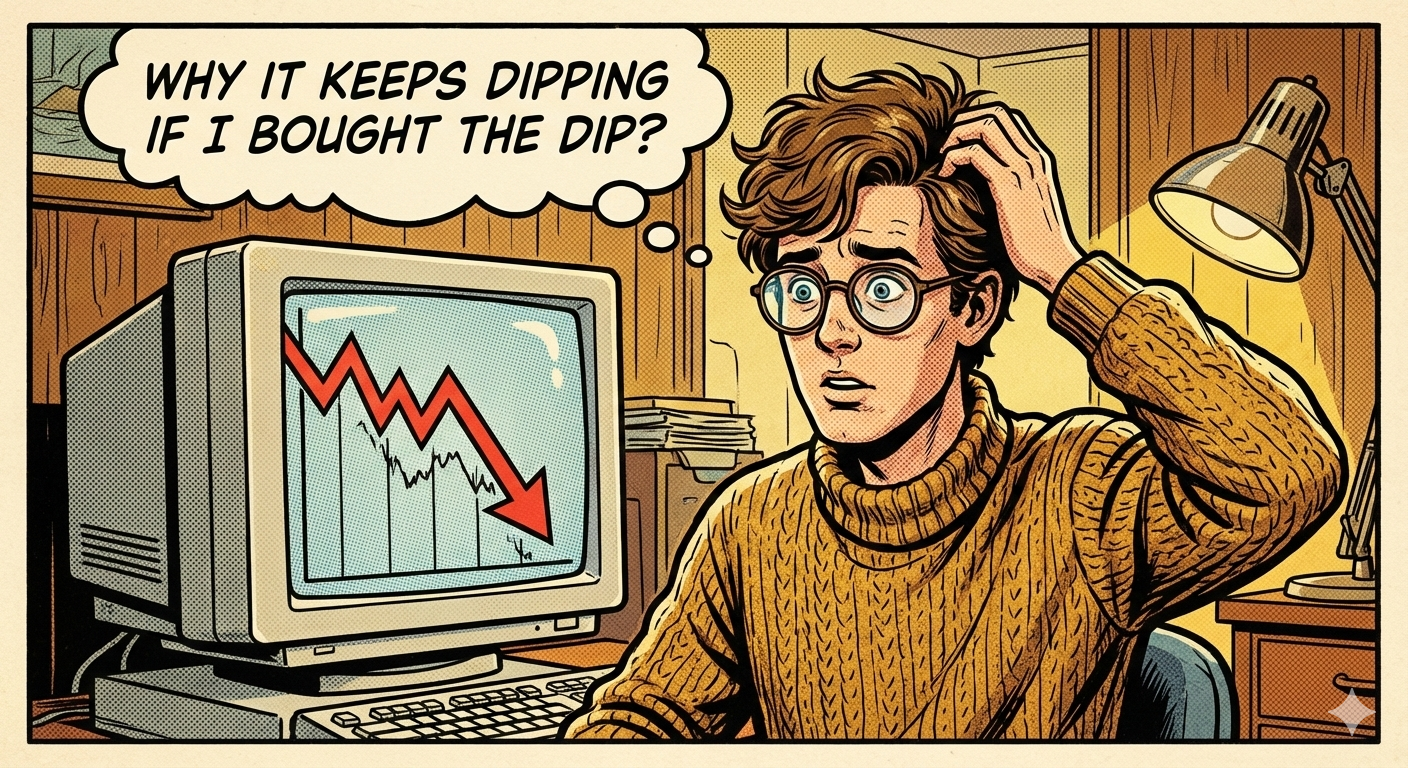

Today, November 20, 2025, I want to talk about a common phrase in the crypto world—one that, far from helping adoption, often has tragic consequences for newcomers dazzled by stories of absurd gains. It’s the almost unanimous cry from anyone with a bit of social media influence: “BUY THE DIP!”

Many of these influencers use emotional strategies, recommending to those new to this world the “wonderful discount” at which crypto assets are supposedly trading, offering future gains with seemingly infallible logic. The result, from my point of view, is often tragic. I once saw a meme that said something like, “What happens if I buy the dip, and it keeps deeping?” That hits home.

Perhaps my comment won’t be to everyone’s liking, and many will argue that “DCA (Dollar-Cost Averaging) is the best long-term investment strategy.” But the truth is, this “buy the dip” mentality, when applied indiscriminately, often contributes to the price falling further and further.

Why does this happen? Humans find it incredibly difficult to stomach a loss. Unfortunately, the feeling of desperation when seeing an investment lose value every single day, and the hopelessness when the situation doesn’t change, often leads these investors to finally dump their holdings at the absolute worst moment.

I agree that you should buy at the best price. But the truly smart move is to do so when there are clear signs of recovery, or at least at a price that reflects reasonable value and doesn’t represent a massive loss if it continues to fall. As I wrote a few weeks ago (read the post here), there’s a maxim in investing and trading: Never try to catch a falling knife.

If you want to enter this world, unfortunately, you must take the time to learn properly, or seek someone to advise or guide you. All investments are risky, and there’s nothing worse than buying high only to sell at the bottom.

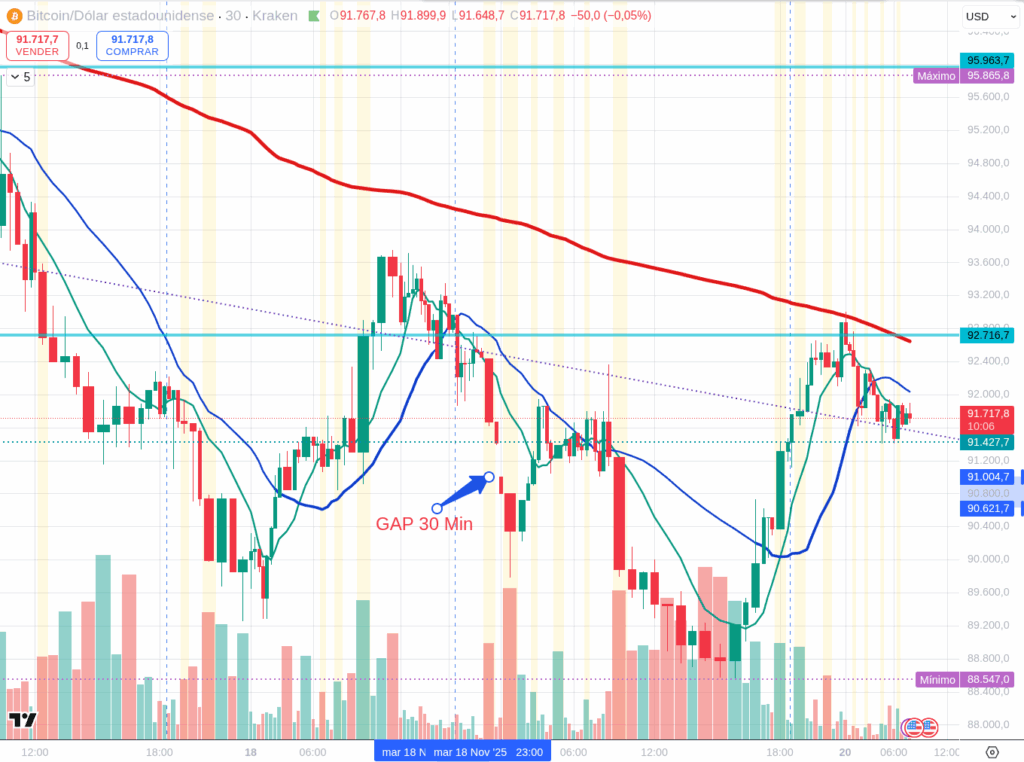

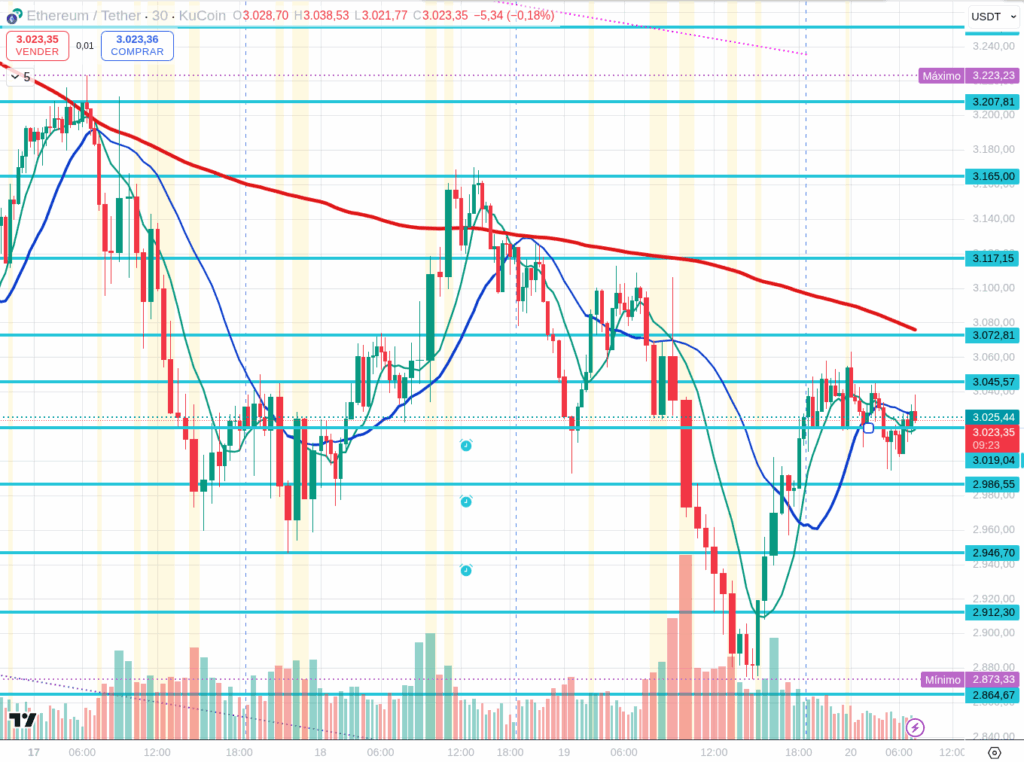

Yesterday’s Market: Another Clear Short

Yesterday, I thought the market might rebound slightly, given the signals it showed on November 18. But the truth is, it was another day of a clear Short for me. It started timidly positive in the European open, only to fall like a lead weight during the American session. Why was it a clear short? Because the price was facing the 30-min SMA 200, forming clear rejection candles. This sent BTC tumbling to $88,500 and ETH to $2,873, with all assets continuing their bearish channel.

I don’t know what will happen today, but what I can tell you is this: if you’re itching to invest long-term, this is not the moment. This is not financial advice, nor am I a financial genius. I simply want you to see the big picture before you act.

Market Anomaly Alert: The Kraken “Glitch”

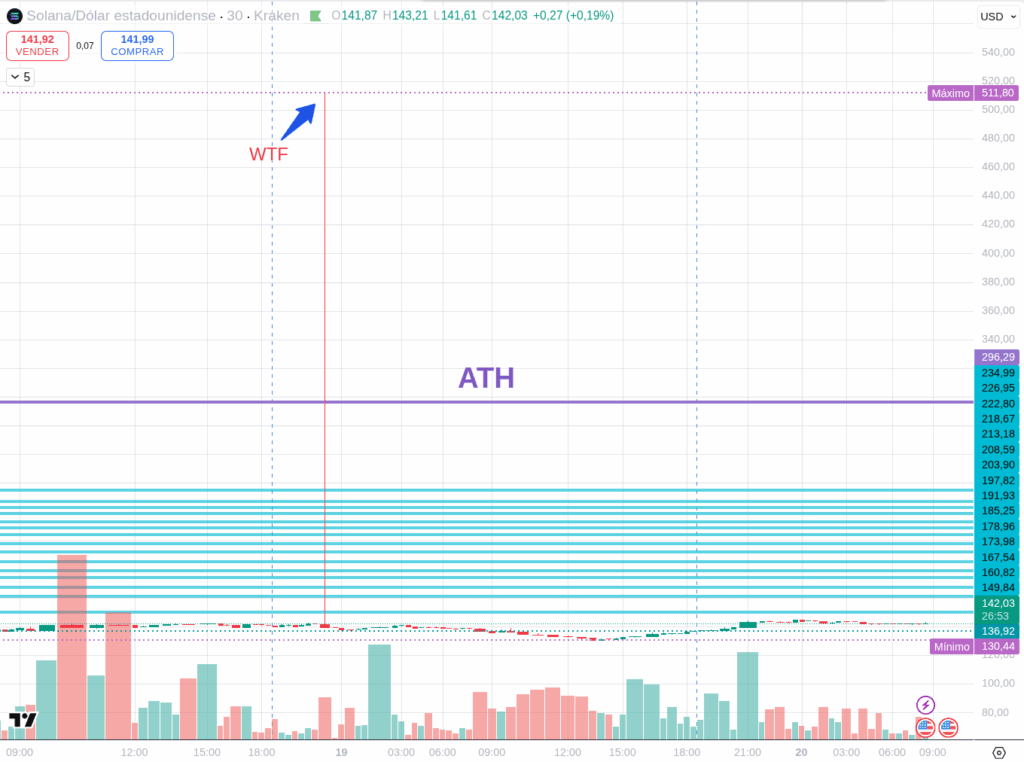

Before we look at the general technical landscape, I must draw your attention to some highly unusual activity observed on the Kraken platform’s 30-minute charts for BTC and SOL.

Based on my past experience trading with Kraken, I ended up leaving the platform because it often entered a state of lethargy or lag during high volatility, causing me to miss trades. This current activity smells like a severe technical issue on their end.

However, the implications are deeply worrying. Look at the SOL/USD chart on Kraken between 23:00 and 23:05 NYC time last night. There is an immense candle—what we might call a massive “Shooting Star”—with a wick spanning from a low of $141.56 all the way up to a staggering high of $511.80.

This isn’t just a chart display error; it means real transactions occurred within that absurd range during those five minutes. For anyone with open orders or stop-losses caught in that wick, it’s a nightmare scenario and a stark reminder of platform-specific risks in this rabid market.

The Macro Picture: Jobless Claims on the Radar

Today, Thursday, November 20, 2025, the key US economic releases are:

- United States (8:30 AM ET): Initial Jobless Claims. This report measures new applications for unemployment benefits. A higher-than-expected number suggests a cooling labor market.

- United States (8:30 AM ET): Philadelphia Fed Manufacturing Index.

These indicators will set the tone for the day, influencing market sentiment.

Technical Snapshot: The Continued Descent

The downtrend continues. The market remains in a state of “fear.”

(Current reference prices before the American open: BTC ~$91,700, ETH ~$3,030, SOL ~$141, BNB ~$901. Remember, these are observations, not predictions.)

BTC (Bitcoin)

- Key Levels: Intraday support around $88,000 – $90,000. Intraday resistance around $93,000 – $94,000.

- Outlook: If BTC holds above $90,000, a technical bounce is possible. A break below $88,000 with volume opens the door to $85,000 or lower.

ETH (Ethereum)

- Key Levels: Intraday support around $2,900 – $3,000. Intraday resistance around $3,150 – $3,200.

- Outlook: ETH shows relative weakness. If it loses $3,000, it could quickly fall towards $2,800.

SOL (Solana)

- Key Levels: Intraday support around $140 – $150. Intraday resistance around $160 – $170.

- Outlook: SOL remains highly volatile. Look for strong defense of the $140-$150 zone for any potential bounce. Be mindful of the Kraken anomaly mentioned above if you trade there.

BNB (BNB)

- Key Levels: Intraday support around $880 – $900. Intraday resistance around $920 – $930.

- Outlook: BNB is an indicator of altcoin risk appetite. Watch for a clean break of resistance for any wider altcoin recovery signal.

Final Thoughts: Prudence Over Emotion

The message is clear: the market is in a precarious state. Ignore the emotional calls to “buy the dip.” True opportunities arise with clear signals, not blind hope. Wait for those signals, protect your capital, and be aware of platform risks like the one seen on Kraken.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/