Hallo zusammen!

It’s Friday, November 28, 2025. The market opens after Thanksgiving, and I have to admit, I feel a bit of fear. Today is “Black Friday.” In my country, for people of my generation, this term is almost always associated with devaluation and banking crises—the opposite of the shopping frenzy it means for the rest of the world.

Despite that historical echo, I believe today could be an important day, at least for BTC.

BTC’s Technical Dilemma

Bitcoin finds itself in a dilemma, trying to decipher its own price action. Is what it’s shown since Sunday, November 23rd, a true reversal signal? Or is it just a small, deceptive bounce within a larger downtrend?

In other words: Is it saying, “I haven’t finished Wave A,” or “I’m starting Wave B”?

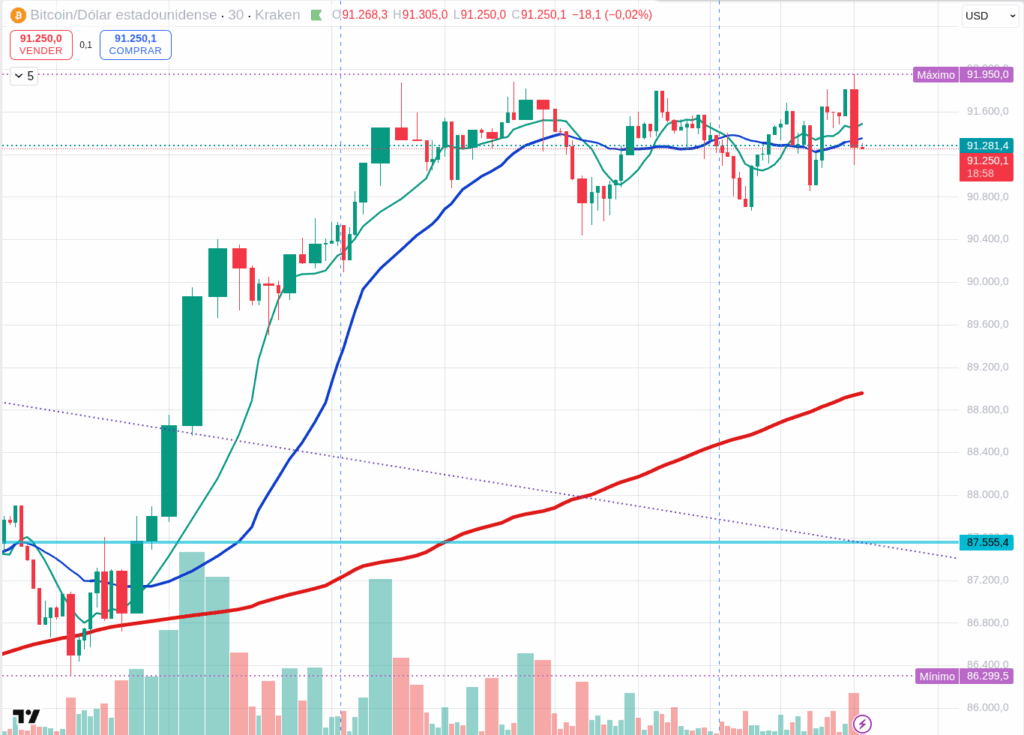

I’ve been reviewing the chart, and I realized I was mistaken in my previous assessment. BTC is still inside the bearish channel. Furthermore, it is currently facing the underside of the long-term trendline it broke, all while dealing with the aftermath of the recent daily Death Cross. It is a formidable technical cluster.

The Volatility Catalysts

To add fuel to the fire, Bitcoin futures contracts expire today. This event invariably makes the price highly volatile as traders roll over positions or close them out. In the 30-minute chart, after advancing from $86,900 to $91,400, BTC is currently consolidating between $91,900 and $90,400. If BTC manages to break $91,900, it is probable that it returns towards $100,000.

Will we see the start of the much-talked-about end-of-year rally today? I don’t know. But grab your popcorn, because the show is about to begin.

The Macro Picture: Reopening and Rebalancing

Today, Friday, November 28, 2025, US markets reopen after the Thanksgiving holiday, though it is a shortened trading session (closing at 1:00 PM ET). While volume might still be lower than average, month-end rebalancing flows can create sudden moves.

- Europe: All eyes are on the preliminary German CPI (inflation) data. A surprise here could move the Euro and global risk sentiment.

- US: No major data, but the market continues to digest the Fed’s cautious stance on the cooling labor market.

Technical Snapshot: Detailed Levels (30-Min Charts)

Let’s dive into the specific support and resistance levels for today’s session, adjusted for current prices.

(Current reference prices: BTC ~$91,300, ETH ~$3,030, SOL ~$140, BNB ~$890. Remember, these are observations, not predictions.)

BTCUSDT (Bitcoin)

BTC is trading in the middle of its current consolidation range.

- Current Price: ~$91,300

- Immediate Resistance: $91,900. The top of the current intraday range. A break here targets higher levels.

- Key Resistance Zone: $97,800 – $98,200. The major hurdle for a bullish reversal.

- Immediate Support: $90,400. The bottom of the current consolidation range.

- Key Support: $86,900. The recent low. Losing this means the downtrend continues.

ETHUSDT (Ethereum)

ETH is showing relative weakness, trading near psychological support.

- Current Price: ~$3,030

- Immediate Resistance: $3,100 – $3,150. ETH needs to reclaim this zone to gain any bullish traction.

- Strong Support: $3,000. A critical psychological level. A clean break below here could accelerate selling.

SOLUSDT (Solana)

SOL has pulled back significantly and is testing support.

- Current Price: ~$140

- Immediate Resistance: $150. The first hurdle for any bounce.

- Support: $138 – $140. SOL must hold this zone to avoid a deeper drop towards previous lows.

BNBUSDT (BNB)

BNB continues to show relative structural strength compared to ETH and SOL.

- Current Price: ~$890

- Immediate Resistance: $900 – $910.

- Support: $880. The key level holding the current immediate structure.

Final Thoughts

The market reopens with BTC consolidating below critical long-term resistance, compounded by the volatility of futures expiry. While BTC holds its range, altcoins like ETH and SOL are testing lower supports. It’s a day for popcorn and careful observation as the month comes to a close.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/