Hallo zusammen!

Apologies for the late post today; I ran into some technical issues this morning.

I won’t dwell too long on my overall market sentiment, as it hasn’t changed significantly. Yesterday, while technically a “green day” for our assets of study (BTC +2.6%, ETH +4.2%, SOL +4.2%, and BNB +2.47%), I view this merely as a technical reaction—a bounce—following the sharp sell-off we witnessed earlier.

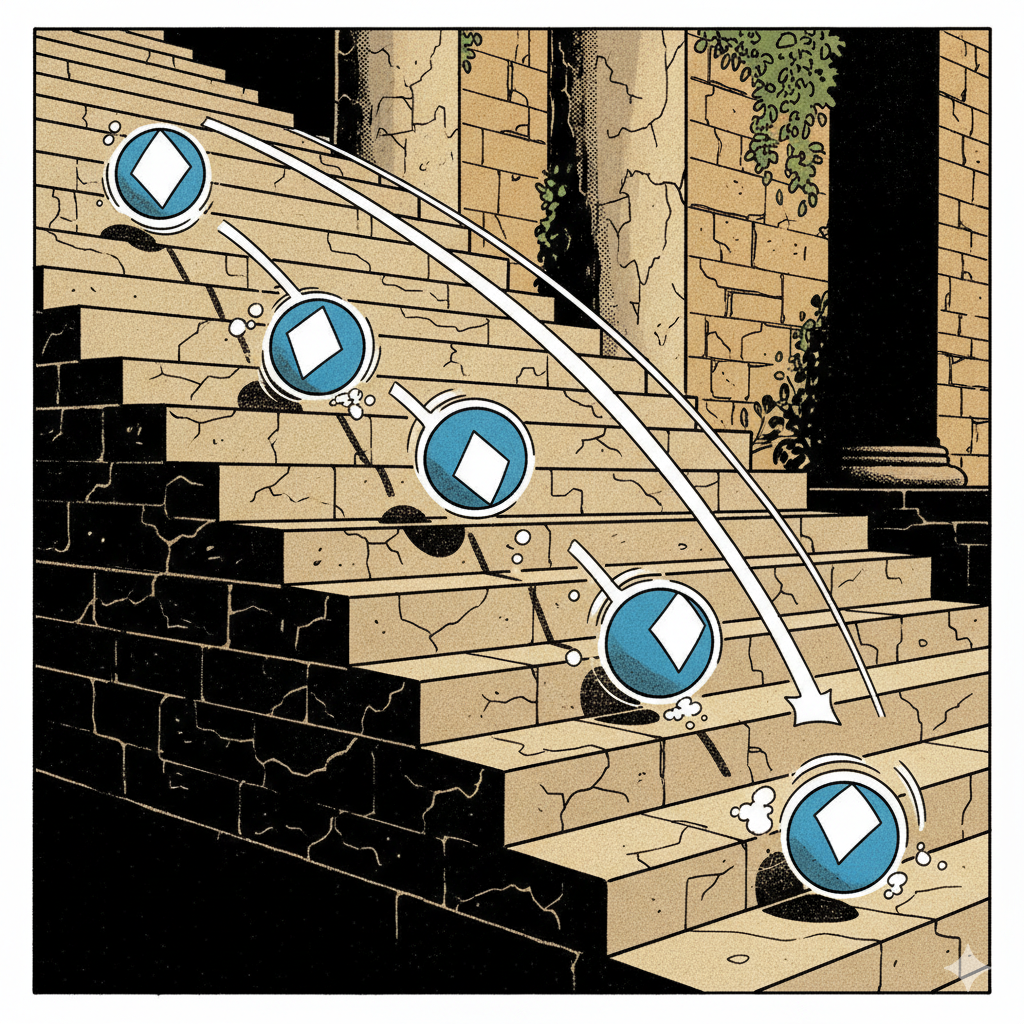

I’m still keeping those long-term correction zones in mind. As I mentioned, the potential targets for SOL could be even deeper, perhaps testing the $80 zone. For BNB, a significant retracement to the $350 area is a possibility in a true bear market. We’ll see what the coming months bring, but it’s worth noting that in declining cycles, January and February are often difficult months for these assets.

But today, we have immediate events to watch.

The Macro Picture: Jobless Claims and FED Speak

Today, Thursday, November 6, 2025, is not a quiet day. We have a block of U.S. data that could easily inject volatility, especially in a market this sensitive.

- Key U.S. Data (Morning ET):

- Initial Jobless Claims (8:30 AM ET / 14:30 CET): This is the main event. A weekly pulse check on the labor market.

- A lower (stronger) number suggests a tight job market, which the FED might see as inflationary (negative for risk assets/crypto).

- A higher (weaker) number suggests cooling, which the market might interpret as a reason for the FED to ease (positive for risk assets/crypto).

- Productivity & Labor Costs (8:30 AM ET): This data is crucial for inflation. Higher productivity is good; higher labor costs are inflationary.

- Challenger Job-Cut Report (7:30 AM ET): An appetizer for the Jobless Claims, showing announced corporate layoffs.

- Initial Jobless Claims (8:30 AM ET / 14:30 CET): This is the main event. A weekly pulse check on the labor market.

- FED Speeches: We also have several FED members (Barr, Williams, Waller, etc.) speaking throughout the day. Any “hawkish” or “dovish” comments from them can easily swing the market.

My Conclusion on the Agenda: Today has plenty of fuel. The combination of U.S. jobless data and FED-speak will impact the NYSE, Nasdaq, and, by extension, the crypto market. European data this morning on activity and inflation will also set the initial tone.

(Note: U.S. and European markets are open and operating on a normal schedule today.)

Technical Analysis: A Fragile Bounce (30-Min Charts)

Let’s look at the charts with the most current prices. After yesterday’s bounce, the market has seen significant selling pressure at the U.S. open, wiping out much of those gains.

(Current reference prices: BTC ~$102,700, ETH ~$3,358, SOL ~$158, BNB ~$940. Remember, these are observations, not predictions or recommendations.)

BTCUSDT (30 min)

Bitcoin, at $102,700, has given back most of yesterday’s recovery and is now testing the lower part of its daily range.

- Immediate Resistance: ~$104,000 – $104,500

- Pivot / Control Zone: ~$102,500 – $103,500

- Key Support: ~$101,000 – $101,500 (The recent low)

What to Watch: * The bounce from the $101,230 low has stalled. The price is now below the pivot, indicating sellers have regained control intraday. * Holding the $101,000 – $101,500 low is critical. A break below this level would confirm the downtrend is resuming. * Indicators: The RSI (30m) is likely back below 50, showing weakness. The MACD, which was attempting a bullish cross, has likely failed or flattened, signaling the end of the rebound’s momentum.

ETHUSDT (30 min)

Ethereum, at $3,358, has fallen hard from its high (near $3,478) and is back in a very vulnerable position.

- Immediate Resistance: ~$3,450 – $3,480 (Yesterday’s high)

- Pivot / Control Zone: ~$3,350 – $3,400

- Key Support: ~$3,270 – $3,300 (The recent low)

What to Watch: * ETH showed relative strength in its bounce yesterday but has given it all back. It’s now trading in a weak pivot zone. * A break below $3,300 would be a very bearish signal, invalidating the bounce and targeting lower supports. * Indicators: RSI (30m) is back in bearish territory. The MACD’s bullish momentum has likely evaporated.

SOLUSDT (30 min)

Solana, at $158, remains the high-beta asset, falling back significantly from its $163 high.

- Immediate Resistance: ~$162 – $164

- Pivot / Control Zone: ~$157 – $160

- Key Support: ~$154 – $155 (The recent low)

What to Watch: * SOL is back in the lower half of its daily range. Its bounce was fast, and its rejection is equally fast. * The $154-$155 low is the key level to watch. A break here would signal a clear continuation of the downtrend. * Indicators: RSI (30m) is likely weak (below 50). The MACD is probably showing a failed bullish attempt.

BNBUSDT (30 min)

BNB, at $940, has also pulled back sharply from its high near $967, now testing its intraday support.

- Immediate Resistance: ~$955 – $965

- Pivot / Control Zone: ~$935 – $945 (Current battleground)

- Key Support: ~$920 – $930

What to Watch: * BNB is testing its pivot zone. How it holds the $935-$945 area after the U.S. data dump will be telling. * A break below $935 would be a sign of weakness, even for this strong performer. * Indicators: RSI (30m) is likely pulling back to the neutral 50 line. The MACD is likely flattening, showing indecision.

Final Thoughts: Don’t Trust the Bounce

Yesterday’s “green day” was, in my view, just a technical rebound. The fact that the market is giving back those gains so quickly this morning, before the main U.S. data, is a sign of underlying weakness.

Today, the Jobless Claims data (8:30 AM ET) and the FED speeches are the main events. As always, these are “tremors” to be respected. In this “rabid” market, it’s best to see how the price reacts to the news and settles before assuming the bounce has any real strength.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/