Hallo zusammen!

Yesterday was nothing short of a bloodbath in the crypto market. Bitcoin (BTC) plummeted -4.70%, Ethereum (ETH) fell a staggering -8.00%, Solana (SOL) dropped -6.6%, and even the resilient BNB was down -5.63%. The market today is threatening another leg down, with BTC currently at $101,500, ETH at $3,300, SOL at $156.40, and BNB at $943.

What’s the origin of this brutal descent? It began with professional traders taking profits. We’ve seen roughly 38.4K BTCs moved off exchanges since October 12, 2025 – a clear signal of smart money de-risking. These strategic sales triggered a cascade, leading to the liquidation of $1.1 billion from over-leveraged traders. The Bitcoin Fear and Greed Index now sits at a stark 20 (Fear).

The Problem with “Buy the Dip”

And, as is typical, the social media influencers have emerged with their rallying cry of “Buy the Dip!” This has, regrettably, led to a surge in buying from retail stakeholders. While many preach the mantra of Dollar-Cost Averaging (DCA), this is emphatically not the time to catch a falling knife.

Nobody ever knows how low the price can truly go. Trying to pinpoint the bottom means losing your fingers in the process. The real problem with attempting to catch a falling knife is psychological: if you buy at $100,000 and the price temporarily plunges to $45,000, you will feel like you’ve lost your money. That feeling will compel you to try and recover some portion, often leading to capitulation after truly gigantic losses.

The End of a Cycle?

What we are witnessing in the crypto market, in my opinion, is the end of the cycle. While we might still see some furious, deceptive bounces (the market, as I define it, is “RABIOSO”), professional players are clearly taking profits, and this process is far from over.

There’s a significant support area for Bitcoin around $92,000 – $93,000, represented by the Bitcoin CME Futures gap from April 23rd. It’s entirely possible that in the coming days, the market will confront this point and achieve a rebound. However, let me be clear: this rebound will not signify the end of the downtrend. It would simply be a technical bounce within a larger corrective phase.

My only advice right now is caution, especially concerning leverage. The crypto market is not for the faint of heart, and its “rabid” nature can decimate over-leveraged positions in the blink of an eye.

The Macro Landscape: PMIs and Private Payroll in Focus

Today, Wednesday, November 5, 2025, is another action-packed day on the macro calendar, both in Europe and the United States. These events can directly influence broader market sentiment, and by extension, our “rabid” crypto market.

- Europe (Morning):

- HCOB Eurozone Services & Composite PMIs (Final, October): These are direct thermometers for the Eurozone economy. Stronger readings can bolster the “soft landing” narrative, generally favoring European equities and risk assets.

- Eurozone PPI (Producer Price Index, September): An early indicator of inflation. If factory-gate prices rise, the market may assume the ECB has less room to ease monetary conditions.

- ECB Member Speeches: Any “hawkish” (inflation-fighting) comments could pressure European stocks and indirectly affect crypto.

- United States (NY Session):

- ADP Employment Change (October): Scheduled for 8:15 AM ET. This is a private payroll estimate, often seen as a precursor to Friday’s Non-Farm Payrolls report. A strong number suggests a tight labor market (bad for risk), while a weak number could signal a loosening (good for risk).

- S&P Global & ISM Services PMIs (October): The ISM Services PMI at 10:00 AM ET is particularly crucial. If it stays well above 50, it suggests the economy is robust (good for earnings but could keep the Fed cautious). A drop into contraction territory could fuel deceleration fears.

- Weekly Crude Inventories (EIA): Less direct, but sharp oil movements can impact inflation expectations, interest rates, and overall market sentiment.

In summary, today’s macro events, particularly the ADP and ISM Services in the U.S., form a potent cocktail that can shift the session’s tone for NYSE, Nasdaq, and crypto. Markets are open as usual today in both the U.S. and Europe.

Technical Snapshot: Deep in the Red (30-Min Charts)

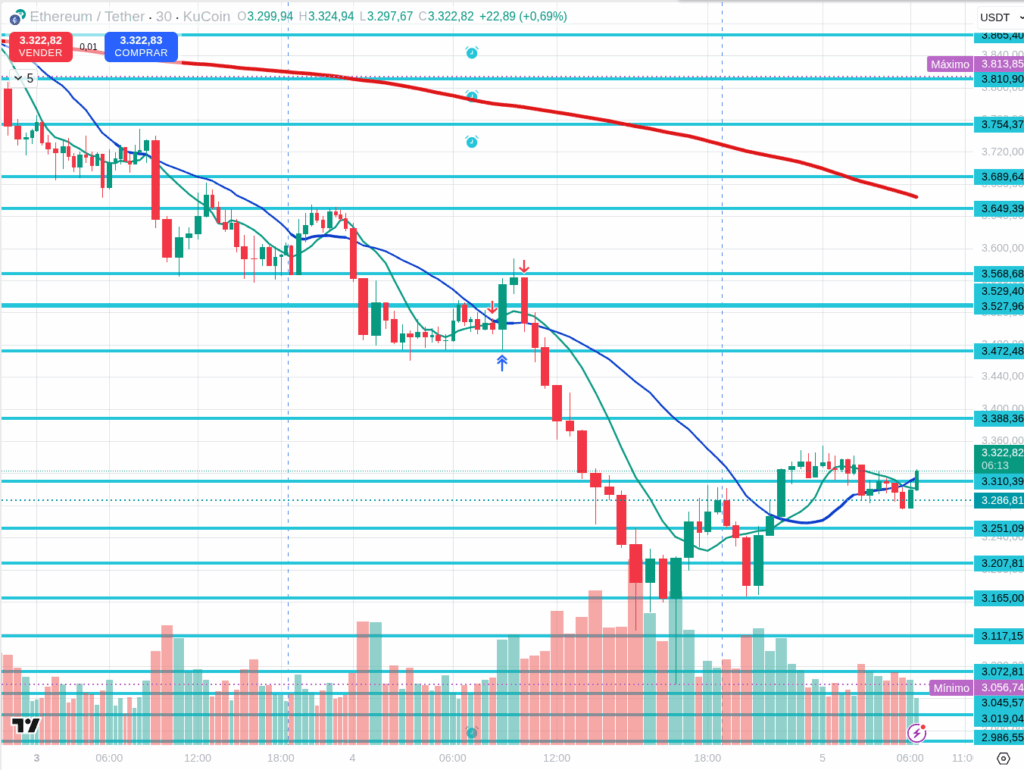

Let’s look at where we stand after yesterday’s plunge, keeping in mind the current prices: BTC ~$101,500, ETH ~$3,300, SOL ~$156.40, and BNB ~$943.

1. Bitcoin (BTCUSDT) * Current State: BTC is down significantly today (-4.70% from its prior close), hovering around $101,500, close to its daily lows. This indicates consistent selling pressure, with bears firmly in control intraday. * Action Price: The $105,000 – $106,000 zone is now clear intraday resistance. Any bounces there are being met with selling. Immediate demand is appearing around $99,000 – $101,000, but without conviction for a strong rebound. * Momentum: RSI is deep in oversold territory (likely in the 30-35 range on 30m), but this simply means the selling has been intense, not that a strong reversal is imminent. MACD is deeply negative. * Outlook: Expect continued choppiness. A break below $99,000 would target the CME gap at $92,000 – $93,000. Until a strong reversal pattern emerges with buying volume, treat rallies as opportunities for bears.

2. Ethereum (ETHUSDT) * Current State: ETH has been hit even harder (-8.00% from its prior close), trading around $3,300. It’s acting as a high-beta asset, amplifying BTC’s weakness. * Action Price: Intraday resistance is now firmly at $3,580 – $3,620. Buyers are trying to defend the $3,080 – $3,150 zone, but any rebounds have been shy. * Momentum: RSI is in deep oversold territory (likely below 30 on 30m). While ripe for a technical bounce, a confirmed reversal needs bullish divergence and a strong rejection candle. MACD is sharply negative. * Outlook: ETH is in an extreme zone. While ripe for a bounce, it’s highly dependent on a dovish macro catalyst from the U.S. or a significant shift in risk appetite. Without it, the path of least resistance remains down.

3. Solana (SOLUSDT) * Current State: SOL is also down significantly (-6.6% from its prior close) to $156.40, maintaining its role as one of the most volatile large-cap assets. * Action Price: Intraday resistance is now at $163 – $166. Initial demand has appeared around $146 – $150, but similar to ETH, without strong follow-through. * Momentum: RSI is deeply oversold, potentially forming bullish divergences if prices continue to make lower lows but RSI holds. MACD is very negative. * Outlook: SOL is in a critical decision zone: either a violent short-squeeze bounce from deep oversold levels or a continuation of the aggressive downtrend if broader market sentiment deteriorates. High risk, high reward, but only with confirmed price action.

4. BNB (BNBUSDT) * Current State: Even BNB, which has shown incredible resilience, is down today (-5.63% from its prior close) to $943. This signals that the selling pressure is broad and powerful, affecting even the stronger players. * Action Price: Immediate resistance is likely around $960 – $970. A key support zone to watch is $900 – $920. * Outlook: While BNB is correcting with the market, its relative strength over the past few weeks is still notable. How it reacts at key support zones will be crucial. If it finds a floor and outperforms the majors on a bounce, it confirms its outlier status. If it breaks strong support, it suggests the market-wide capitulation is truly deep.

Final Thoughts: Caution, The Market Is “Rabioso”

Today’s macro data (ADP, ISM Services in the U.S.; PMIs, PPI in Europe) provides ample fuel for significant market moves. Combine that with the “bloodbath” we just witnessed and the psychological pitfalls of “falling knives,” and we have a recipe for extreme volatility.

My core message remains: caution. The crypto market is “RABIOSO.” Professionals are taking profits, and the cycle appears to be ending. While sharp bounces might occur, they are likely temporary. Avoid excessive leverage, and prioritize capital preservation over chasing bottoms. We are in a phase where patience and strict risk management are your best friends.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/