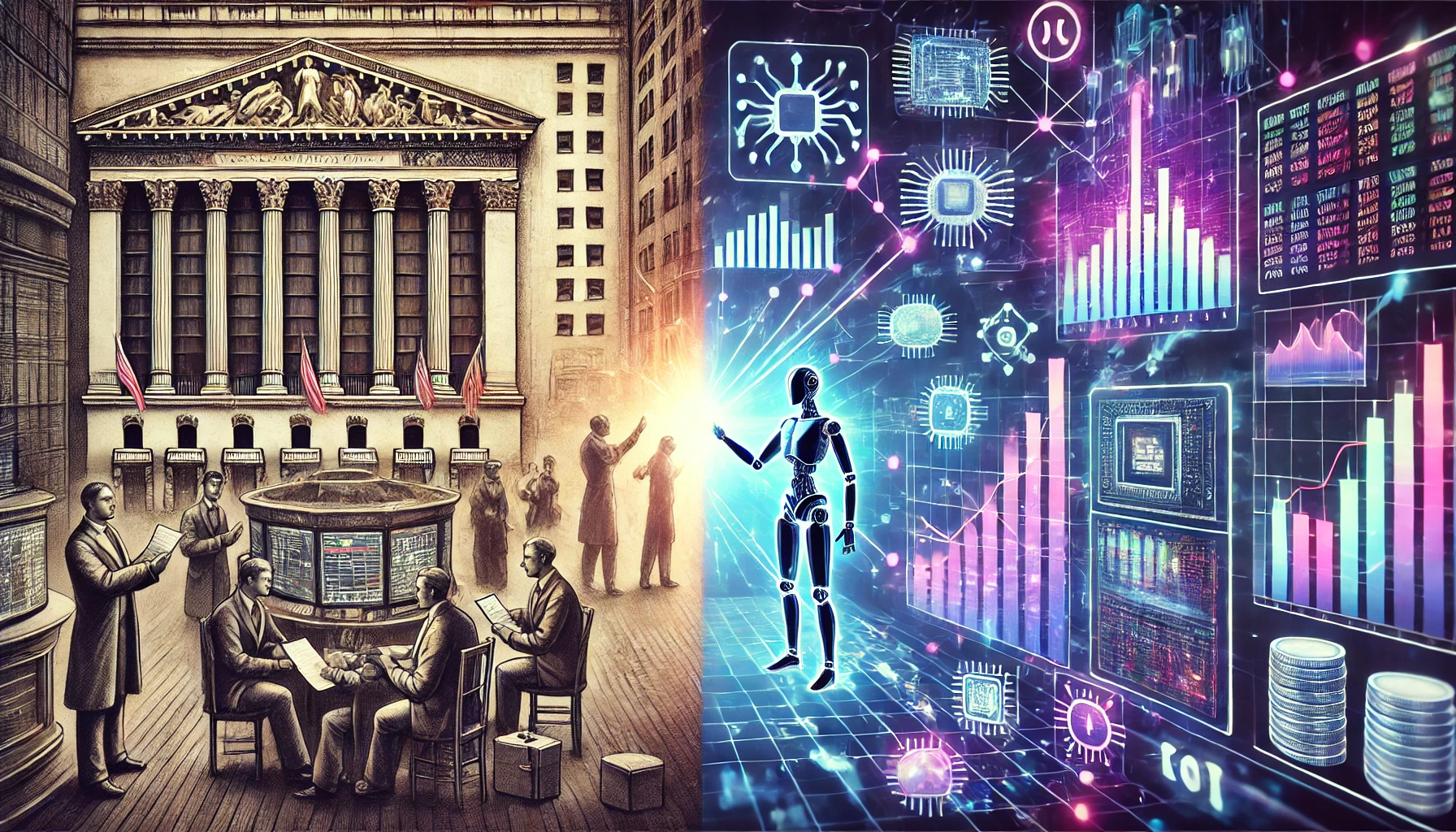

The world of trading has undergone a remarkable transformation over the past century. What was once a manual, labor-intensive process dominated by phone calls and face-to-face interactions has evolved into a highly automated, technology-driven industry. Today, trading is faster, more efficient, and more accessible than ever before, thanks to the relentless march of technological innovation. But how did we get here, and where are we headed? Let’s take a deep dive into the evolution of trading and explore what the future holds.

The Early Days: Trading by Phone and Open Outcry

In the early 20th century, trading was a far cry from the digital experience we know today. Transactions were conducted primarily over the phone, with brokers calling clients to execute trades. The New York Stock Exchange (NYSE) and other major exchanges were bustling hubs of activity, where traders gathered in physical trading pits to buy and sell securities through a system known as “open outcry.” This method involved shouting and hand signals to communicate orders, creating a chaotic yet oddly efficient marketplace.

While this system worked for its time, it was slow, prone to human error, and limited by geographical constraints. The process of executing a trade could take minutes or even hours, and only those with direct access to the trading floor could participate effectively.

In the ever-evolving world of trading, the only constant is change. Embrace innovation, adapt to technology, and let the future of finance be shaped by those who dare to think beyond the limits of yesterday.

The Digital Revolution: Online Trading and Electronic Platforms

The advent of the internet in the late 20th century marked a turning point for the trading industry. With the rise of electronic trading platforms, brokers and investors could now execute trades from anywhere in the world with an internet connection. This shift democratized trading, allowing retail investors to participate in markets that were once the exclusive domain of institutional players.

Terminals like Bloomberg and Reuters became essential tools for traders, providing real-time market data, news, and analytics. These platforms not only increased the speed and efficiency of trading but also introduced a level of transparency that was previously unimaginable. Suddenly, traders could access global markets, analyze vast amounts of data, and execute trades in milliseconds.

The Rise of Algorithmic Trading and Automation

The Rise of Algorithmic Trading and Automation

As technology continued to advance, the trading landscape underwent another seismic shift. The introduction of algorithmic trading in the early 2000s revolutionized the way markets operated. Algorithms, or “algos,” allowed traders to automate their strategies, executing trades based on predefined criteria without human intervention. This innovation brought unprecedented speed and precision to the markets, enabling traders to capitalize on opportunities that would have been impossible to exploit manually.

But the real game-changer came with the integration of machine learning (ML) and deep learning (DL) into trading systems. These technologies enabled algorithms to learn from historical data, identify patterns, and adapt to changing market conditions in real time. Today, a significant portion of trading activity is driven by sophisticated AI-powered systems that can process vast amounts of data, predict market movements, and execute trades with incredible accuracy.

The Present: AI, Machine Learning, and the Dominance of Robots

In the current era, trading has become increasingly dominated by robots and AI-driven systems. High-frequency trading (HFT) firms, for example, use advanced algorithms to execute thousands of trades per second, capitalizing on minute price discrepancies that are invisible to the human eye. Meanwhile, machine learning models are being used to analyze everything from market trends and economic indicators to social media sentiment and news articles.

These technologies have not only increased the efficiency of trading but have also leveled the playing field. Retail investors now have access to tools and platforms that were once reserved for institutional traders, allowing them to compete in an increasingly complex and fast-paced market.

The Future of Trading: A Glimpse into Tomorrow

So, what does the future hold for trading? As technology continues to evolve, we can expect even more profound changes in the way markets operate. Here are a few possibilities:

- Fully Autonomous Trading Systems: In the near future, we may see the rise of fully autonomous trading systems that require little to no human intervention. These systems will be capable of analyzing global markets, identifying opportunities, and executing trades entirely on their own, using advanced AI and machine learning algorithms.

- Quantum Computing: The advent of quantum computing could revolutionize trading by enabling the processing of vast amounts of data at speeds that are currently unimaginable. This could lead to the development of even more sophisticated trading algorithms and strategies.

- Decentralized Finance (DeFi): The rise of blockchain technology and decentralized finance (DeFi) could disrupt traditional trading by eliminating the need for intermediaries like brokers and exchanges. Smart contracts and decentralized platforms could enable peer-to-peer trading with greater transparency and lower costs.

- Personalized AI Advisors: As AI becomes more advanced, we may see the emergence of personalized trading advisors that can tailor strategies to individual investors based on their risk tolerance, financial goals, and market conditions.

- Ethical and Regulatory Challenges: As trading becomes increasingly automated, regulators will face new challenges in ensuring market fairness and preventing manipulation. The ethical implications of AI-driven trading, such as the potential for bias in algorithms, will also need to be addressed.

Conclusion: Embracing the Future

The evolution of trading from phone-based transactions to AI-driven systems is a testament to the power of technological innovation. As we look to the future, it’s clear that technology will continue to shape the industry in ways we can only begin to imagine. While the rise of automation and AI presents exciting opportunities, it also raises important questions about ethics, regulation, and the role of human judgment in an increasingly digital world.

For traders and investors, the key to success in this new era will be adaptability. Embracing technological innovations, staying informed about emerging trends, and understanding the implications of AI and automation will be essential for navigating the future of trading. One thing is certain: the trading landscape will continue to evolve, and those who are prepared to embrace change will be the ones who thrive.

Leave a Reply

You must be logged in to post a comment.