Hallo zusammen!

Today feels like a continuation of a crucial lesson: the market truly does what it wants, not what you wish it would. Yesterday, the pre-market started with strong positive momentum across BTC, ETH, and SOL. It looked like a textbook setup for continuation. Yet, as so often happens, everything collapsed after the lunch break, around 2 PM NYC time, turning a promising day into a frustrating one. The “textbook play” was invalidated.

This reinforces a core principle for me: while many are betting on Bitcoin (BTC) making new All-Time Highs (ATHs) this Q4, and Ethereum (ETH) following suit, I’m personally a bit skeptical. If we do see new ATHs, I believe they might be fleeting, potentially marking the last gasp of this cycle before a significant correction. That correction, when it comes, will undoubtedly present fresh entry opportunities. Nothing is ever certain in these markets.

The Macro Picture: Subtle Signals from the FED

For today, October 29, 2025, there isn’t a major, scheduled Federal Reserve policy announcement (like an interest rate decision). However, that doesn’t mean the FED is entirely out of the picture.

- Potential for FED Member Speeches: It’s quite common for various FED officials to give speeches or interviews. If any of these contain unexpected comments on inflation, the economy, or future policy, they could certainly inject volatility into the market.

- FOMC Meeting Minutes: Another possibility is the release of detailed minutes from a previous FOMC meeting. These minutes can reveal insights into the committee’s thinking and disagreements, which can move markets. These are typically released at 2:00 PM ET.

My Operational Approach: Even without a “main event” from the FED, the potential for market-moving comments from officials or the release of minutes means vigilance is required. My rule remains: if there’s any significant FED-related announcement (or speech with new information), it’s best to wait for the tremor to pass, and then wait a prudent amount of time for the waters to calm. Assets will eventually return to their habitual movement. If a price extends too far in one direction without fundamental backing, it will sooner or later revert to a more normal level. Your portfolio will thank you for this patience.

Technical Analysis: Re-evaluating After Yesterday’s Turnaround (30-Min Charts)

Let’s adjust our technical map after yesterday’s turnaround, focusing on current price action and key levels.

(Current reference prices: BTC ~$113,100, ETH ~$4,000, SOL ~$196.75. Remember, these are observations, not predictions or recommendations.)

BTCUSDT (30 min)

Bitcoin, now around $113,100, saw a significant pullback yesterday, but is now attempting to find its footing again.

- Immediate Resistance: ~$114,500 – $115,500

- Pivot / Control Zone: ~$112,500 – $113,500 (Current battleground)

- Key Support: ~$111,000 – $112,000

What to Watch: * BTC is currently trading within its pivot zone. For bullish momentum to re-establish, a clean close above $113,500 and then challenging the $114,500 resistance would be needed. * A rejection from the $113,500-$114,500 area would signal continued weakness. * On the downside, a decisive break and close below $112,500 could open the path towards the $111,000-$112,000 support.

My Bias: Cautious. Yesterday’s reversal was significant. I need to see clear conviction before considering a directional move.

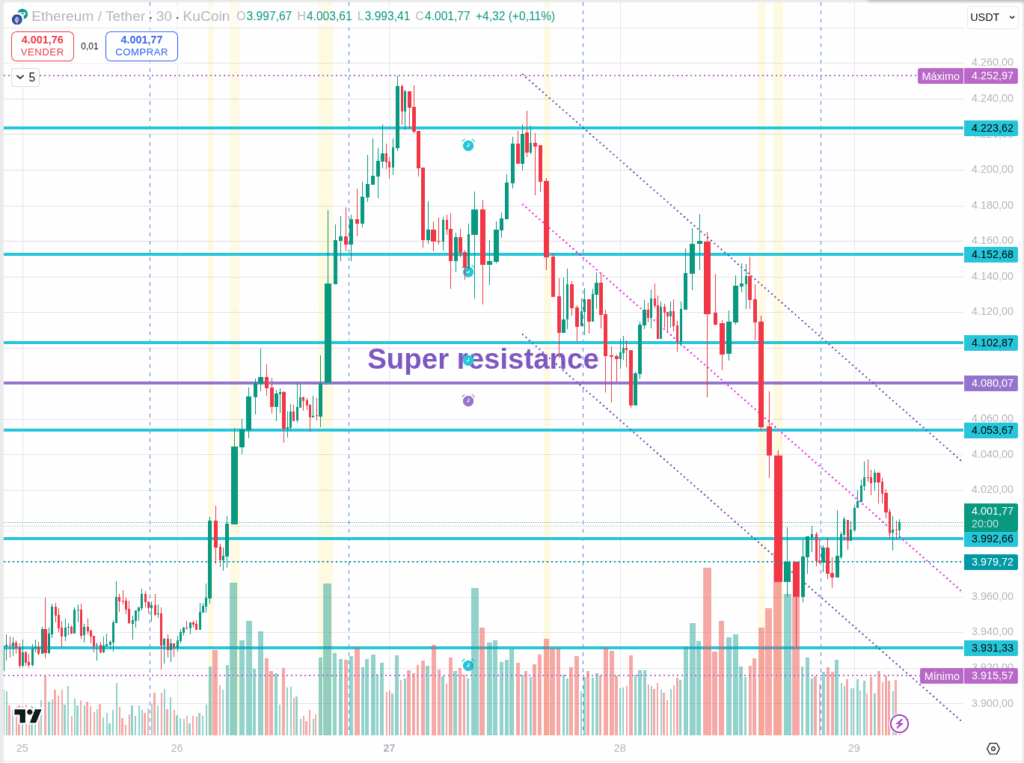

ETHUSDT (30 min)

Ethereum, at a crucial psychological level of $4,000, witnessed a strong rejection after its breakout attempt yesterday.

- Immediate Resistance (Former Super-Resistance / Current Pivot): ~$4,050 – $4,100

- Pivot / Control Zone: ~$3,980 – $4,020 (The critical $4,000 psychological level)

- Key Support: ~$3,880 – $3,950

What to Watch: * ETH’s rejection after breaching $4,080 and its return to $4,000 is a classic “false breakout” scenario for now. * The $4,000 mark is now acting as a critical psychological pivot. Holding above it is key for any immediate bullish recovery. * For strength, ETH needs to reclaim and hold above $4,020 and then target the $4,050-$4,100 resistance. * A break and close below $3,980 would open the door for a test of the $3,880-$3,950 support zone.

My Bias: Neutral to slightly bearish given the failed breakout. Patience is essential to see how $4,000 reacts.

SOLUSDT (30 min)

Solana, currently at $196.75, also experienced a significant pullback yesterday after a strong start.

- Immediate Resistance: ~$200 – $203 (The psychological $200 mark)

- Pivot / Control Zone: ~$195 – $198

- Key Support: ~$190 – $193

What to Watch: * SOL needs to reclaim the $200 psychological level with conviction to regain bullish momentum. * A rejection from the $198-$200 area would indicate continued weakness. * A break and close below $195 could lead to a test of the $190-$193 support.

My Bias: Observing. While its ATH is $295, current price action requires confirmation before assuming continued upside.

Final Thoughts: Market Humility & Patience

Today is a testament to market humility. What looked like a strong “book play” yesterday was swiftly invalidated. We must remember that the market ultimately does what it pleases. While discussions about new ATHs for BTC and ETH in Q4 are common, my skepticism leans towards them being potentially fleeting, marking the end of the current cycle’s impulse.

With potential FED-related “whispers” today (especially around 2:00 PM ET for minutes), patience is paramount. Let the tremors pass, allow the waters to calm, and then react to confirmed price action. Your portfolio will thank you.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/