Hallo zusammen!

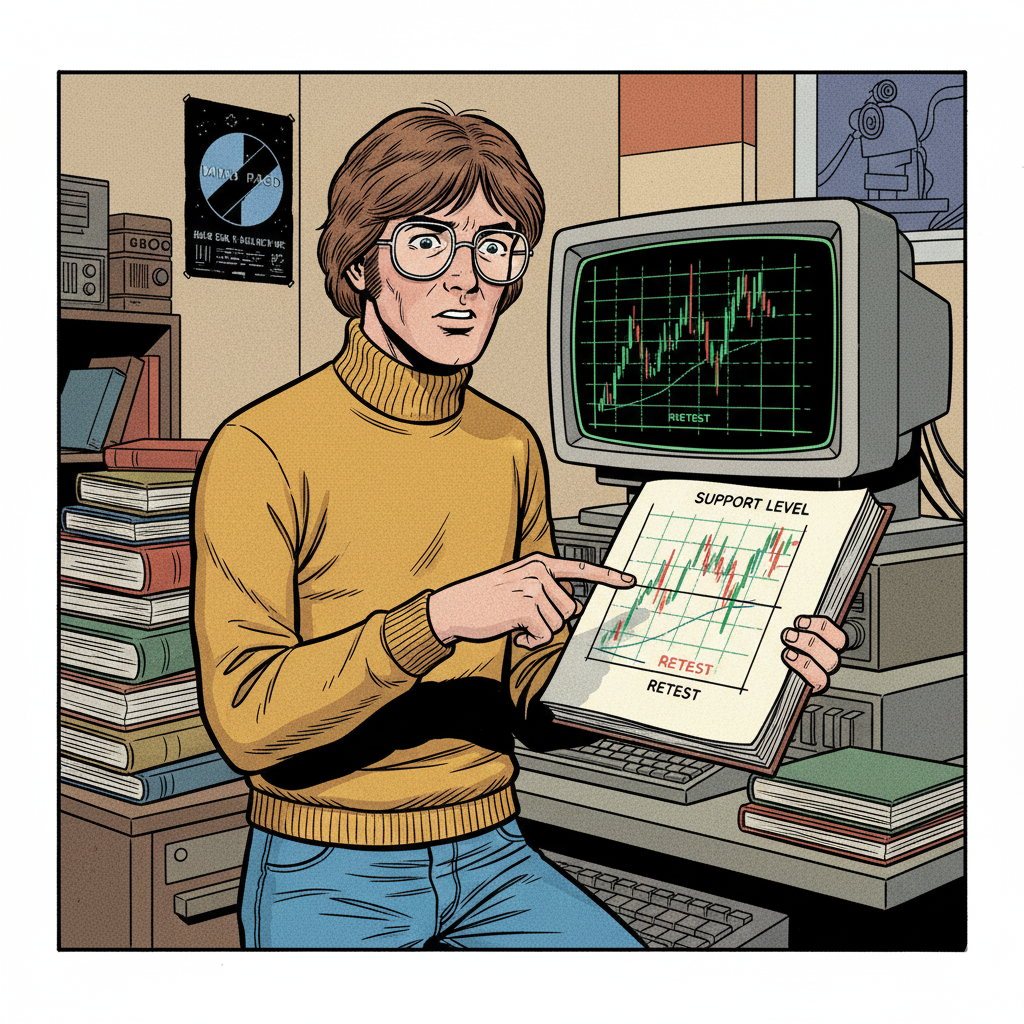

Just as I mentioned yesterday, #Ethereum (ETH) truly broke through my “super-resistance” zone at $4,080 with significant intent. And as anticipated, despite the price climbing to around $4,220 at the time of writing yesterday, a retest of that crucial zone was highly probable. Well, it happened. After facing resistance at $4,250, the price indeed pulled back following the American market open yesterday and closed in negative territory. This retest is a textbook move, now we see if that former resistance can hold as new support.

Bitcoin (BTC), on the other hand, saw a reversal at $116,000 but has admirably held the $113,700 support zone. This shows a certain resilience even amidst the slight pullback.

Looking at today, there are no major economic announcements on the horizon. My focus, then, remains firmly on observing price behavior and volume. This quieter macro day allows for a more granular technical analysis.

Solana (SOL), interestingly, has shown a bit more conviction. It appears to have more room to run, especially considering its All-Time High (ATH) stands at $295. While I personally only observe Solana and don’t actively trade it (my focus is on BTC, ETH, S&P, and NASDAQ), its independent strength is noteworthy. I know many traders work with a thousand assets, but I prefer to concentrate on what I know best; there are plenty of others who do a far better job with a broader scope.

I want to reiterate my approach: I am neither a Bull nor a Bear. My objective is simply to understand what’s likely to unfold during the day. The core purpose of sharing these posts is to highlight key events that might impact trading operations, thereby helping to avoid trading during major announcements like those from the FED. In my opinion, such events are often untradeable; it’s always better to wait for the tremor to pass – your portfolio will thank you.

The Macro Picture: A Day for Technicals, With an Eye on the Week Ahead

Today, Tuesday, October 28, 2025, offers a relatively calm macroeconomic landscape.

- U.S. Data: We have some “medium impact” indicators on the calendar, such as the Consumer Confidence Index for October and the Richmond Federal Reserve Manufacturing Index for October. While these can cause minor ripples, they are unlikely to trigger a major market shift.

- Europe: Important data, including GDP and interest rate decisions, are slated for later in the week, not today.

- Trade Negotiations: The ongoing trade negotiations between the U.S. and China continue to be a background factor, potentially influencing risk appetite.

Operational Implication: This “macro breather” provides an opportunity to refine our trading strategies and set up technical alerts without the immediate pressure of high-impact news. It’s a day for preparation and technical observation, rather than expecting a “big shot” from a fundamental catalyst.

Technical Analysis: Observing Price & Volume (30-Min Charts)

Let’s dive into the charts, focusing on price action, volume, and confirmations, given the quieter macro day.

(Current reference prices: BTC ~$114,500, ETH ~$4,118, SOL ~$201.85. Remember, these are observations, not predictions or recommendations.)

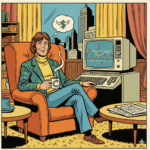

BTCUSDT (30 min)

Bitcoin, currently around $114,500, shows resilience, holding above key support after its rejection from $116,000.

- Immediate Resistance: ~$115,500 – $116,500 (That $116,000 zone remains key)

- Pivot / Control Zone: ~$113,700 – $114,700 (Where it’s currently holding support)

- Key Support: ~$112,000 – $113,000

What to Watch: * BTC’s ability to hold the $113,700-$114,700 zone is crucial. This shows buyers are stepping in after the pullback. * For upside, it needs to reclaim and push above $115,500 towards $116,000 with strong volume. * A break below the $113,700 support could signal further downside towards $112,000. * My Bias: Vigilant. Await clear direction.

ETHUSDT (30 min)

Ethereum, at $4,118, is undergoing the expected retest of its former “super-resistance” at $4,080.

- Immediate Resistance: ~$4,150 – $4,220

- Pivot / Control Zone (Retest Zone): ~$4,080 – $4,120 (The former resistance, now potential support)

- Key Support: ~$3,950 – $4,050

What to Watch: * This retest of the $4,080-$4,120 zone is critical. A successful bounce from here would confirm the breakout and turn this area into strong support. * A failure to hold this zone, with a decisive close below $4,080, would be a bearish signal, potentially indicating a false breakout. * For continued strength, ETH needs to bounce from this zone and reclaim $4,150-$4,220. * My Bias: Observing the retest. Confirmation of $4,080 as support is key.

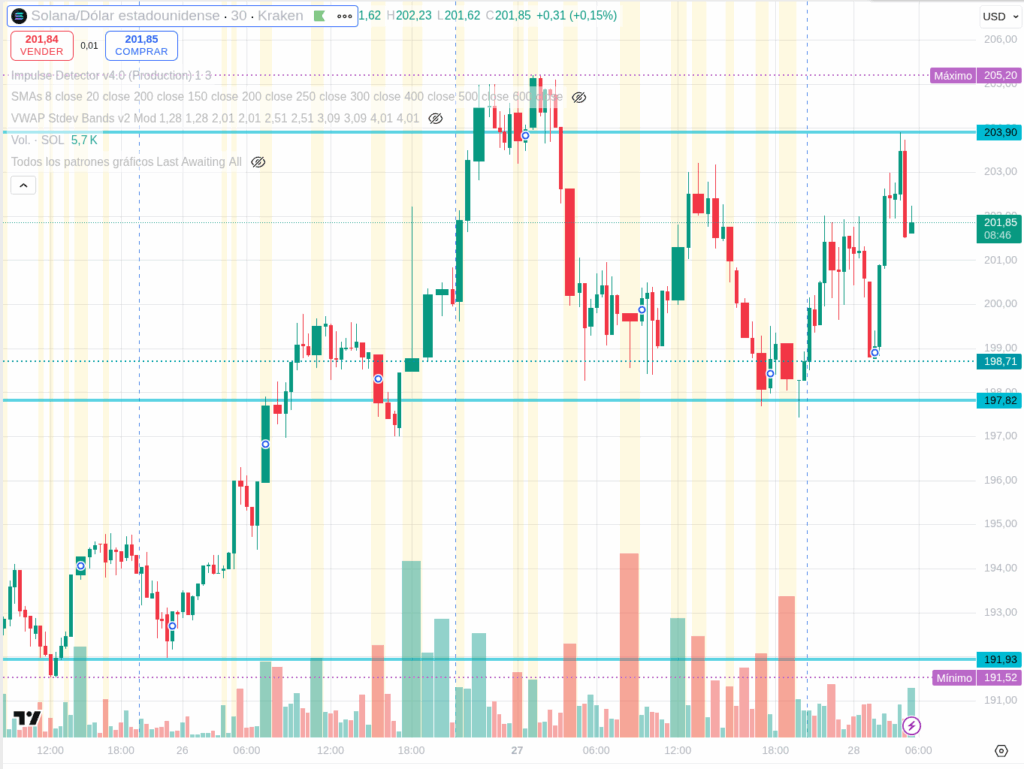

SOLUSDT (30 min)

Solana, currently at $201.85, shows strong momentum and has pushed above the psychological $200 level.

- Immediate Resistance: ~$205 – $210

- Pivot / Control Zone: ~$198 – $202 (Where it’s currently battling)

- Key Support: ~$190 – $195

What to Watch: * SOL’s push above $200 is bullish. The challenge now is to hold this level as support. * Continued momentum above $202 could see it pushing towards $205 and potentially higher. * A pullback below $198 would suggest a failed breakout from $200, making the $190-$195 zone the next key support. * My Bias: Observing its strength. If it can hold above $200, it’s impressive.

Final Thoughts: Preparation is Key

Today, with a relatively quiet macro calendar, the focus is squarely on technical action. ETH’s retest of its breakout zone is the most compelling event to watch. BTC’s ability to hold support, and SOL’s continued strength, also provide key insights.

As always, remember my mantra: “Wait for the tremor to pass” when major macro events loom later in the week. Use this quieter day to prepare your strategy, define your key levels, and set your alerts. Professional trading thrives on patience and preparation.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/