Hallo zusammen!

Will “Uptober” finally live up to its name and deliver a truly positive month? That’s the question on everyone’s mind as we kick off a new week.

The crypto market, true to its nature, never rests – and that’s both its beauty and its beast. Weekends, in particular, often deliver major surprises. Think back to the major crypto ban by China; that hit on a Saturday morning in European time. Or the FTX debacle, if I recall correctly, also unfolded on a Saturday. It’s almost as if the “cryptobros” take a break, only to wake up Sunday afternoon, looking to “fish” for opportunities.

However, from my perspective, much of this weekend volatility is engineered for novices to lose money. There are very few genuine opportunities, as the American market opening on Monday truly sets the tone and provides the most reliable signals for the week ahead.

That said, the crypto market did stage a respectable recovery over the weekend, turning around what had been shaping up to be a negative week. This positive momentum continued into Monday’s European session.

Ethereum (ETH), notably, showcased significant strength, surpassing my “super-resistance” marked at $4,080 with conviction and volume. While it starts the week on a strong foot, logical operative practice dictates a retesting of that crucial zone. And it appears that’s precisely what ETH is doing right now, showing a slight pullback after hitting around $4,252 (near its current levels).

Bitcoin (BTC) also broke above $113,700, a positive sign, but it quickly ran into the significant resistance at $116,000.

For my part, I observe Solana (SOL), but I don’t actively trade it. My core focus remains on BTC, ETH, S&P, and NASDAQ. I know many traders operate across a thousand assets, but I prefer to focus on what I know best; there are others who do a far better job with a broader scope. I am neither a bull nor a bear; my goal is simply to discern what might unfold during the day and, most importantly, identify significant events that could impact trading.

This brings me to a crucial point: avoiding operations during major announcements like those from the FED. In my opinion, these are untradeable events. When a major announcement looms, it’s always best to wait for the tremor to pass; your portfolio will thank you.

The Macro Picture: Calm Before the Storm

Today, Monday, October 27, 2025, the macroeconomic calendar is relatively light, offering a brief period of calm before the week’s more significant events.

- U.S. Data: Minor reports are due today, but the heavy hitters – particularly the Federal Reserve (Fed) announcements and crucial inflation data (Core PCE) – are concentrated towards Wednesday and Thursday.

- Europe: Similarly, major economic data from Europe is also anticipated mid-week, not today.

Operational Implication: The absence of high-impact macro news today provides a window of potentially lower volatility from a macro perspective. However, it also serves as a critical preparatory period for the larger events later in the week. For us, this means it’s a good day to review exposures, adjust stop-losses, or set up alerts in anticipation of greater risk ahead.

Technical Analysis: Re-evaluating After the Weekend Rally (30-Min Charts from Binance)

Let’s dive into the charts, re-evaluating our key levels after the weekend’s movements and the current positive start to the week.

(Current reference prices: BTC ~$114,000, ETH ~$4,168, SOL ~$200. Remember, these are observations, not predictions or recommendations.)

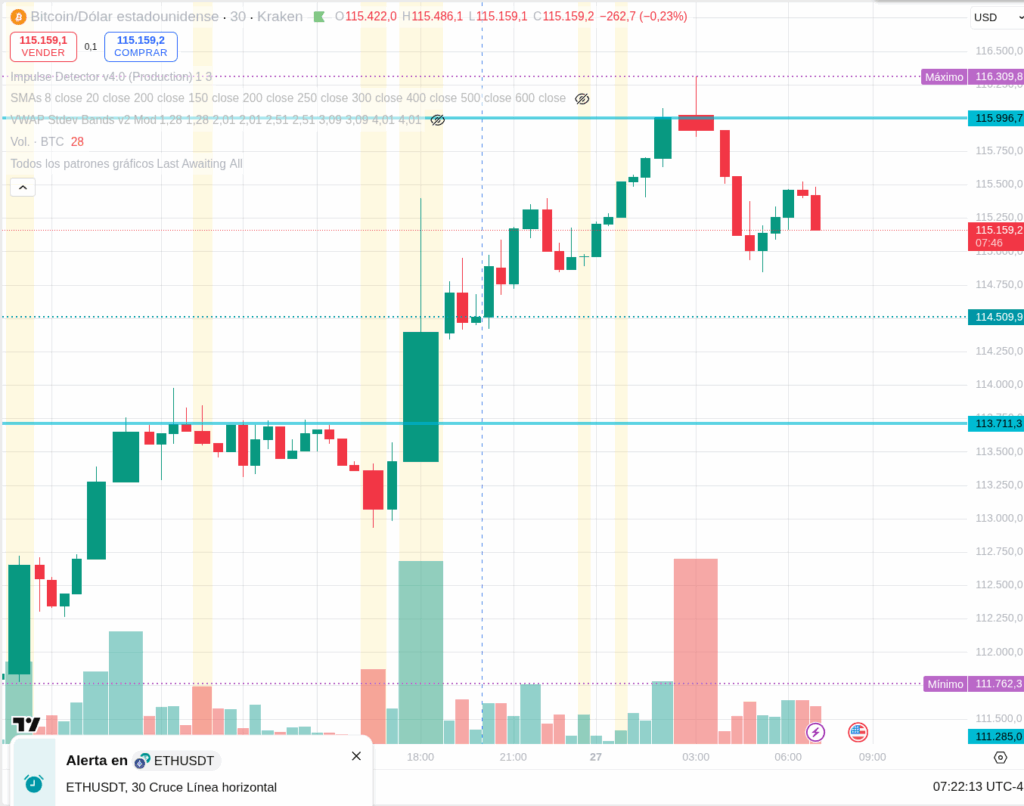

BTCUSDT (30 min)

Bitcoin, currently around $114,000, shows solid recovery but is facing immediate overhead resistance after breaking through previous levels.

- Immediate Resistance: ~$115,500 – $116,500 (That strong $116,000 resistance)

- Pivot / Control Zone: ~$113,500 – $114,500

- Key Support: ~$112,000 – $113,000

What to Watch: * BTC has powered through $113,700. The immediate challenge is sustaining momentum towards and eventually above $116,000 with conviction. * A clean break above $116,000 with volume would signal continued strength. * A rejection from the $115,500-$116,500 area could see it retesting the $113,500-$114,500 pivot zone. * My Bias: Vigilant. I’m watching for confirmation around that $116,000 mark.

ETHUSDT (30 min)

Ethereum, trading at $4,168, has decisively broken above its “super-resistance” of $4,080, but is now seemingly in a retesting phase.

- Immediate Resistance: ~$4,200 – $4,280 (Where it turned near $4,252)

- Pivot / Control Zone (Former Super-Resistance): ~$4,080 – $4,150

- Key Support: ~$3,950 – $4,050

What to Watch: * The break above $4,080 with volume is a very bullish sign. The current price action around $4,168 suggests it’s retesting that former resistance as new support. This is a textbook move. * For continued strength, ETH needs to hold above the $4,080-$4,150 zone. A successful retest would solidify this breakout. * A failure to hold this zone could signal a false breakout, pulling it back towards $3,950-$4,050. * My Bias: Bullish, but cautious during the retest. Holding $4,080-$4,150 is paramount.

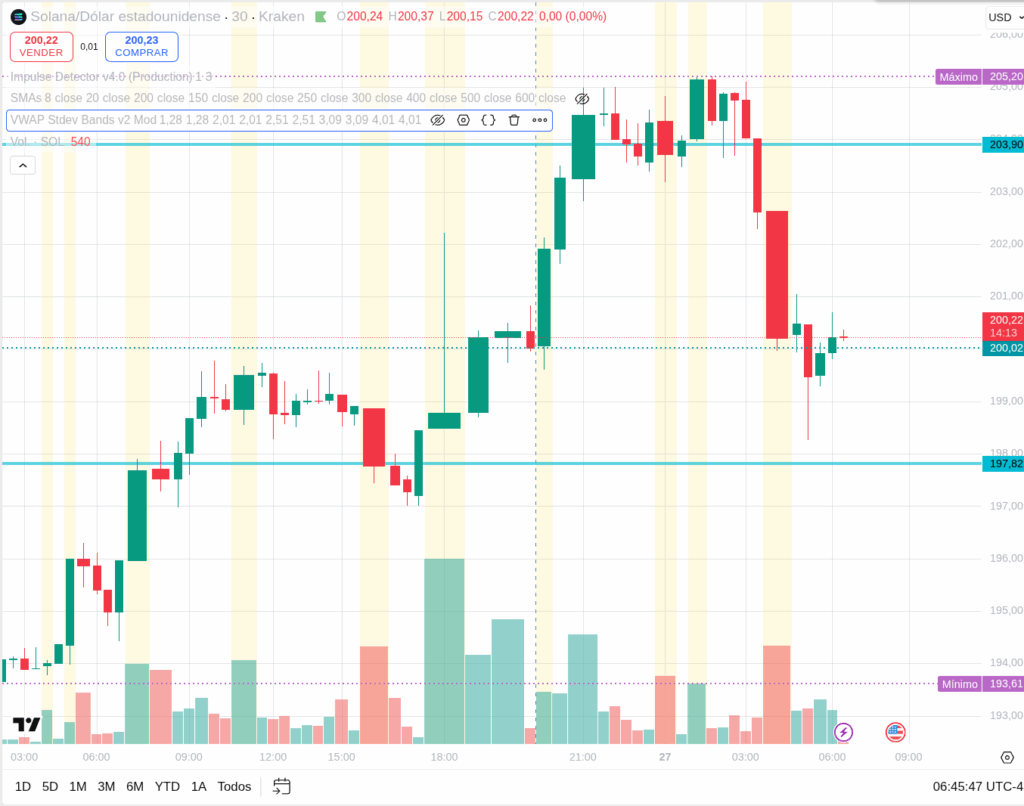

SOLUSDT (30 min)

Solana, currently at $200, has shown impressive strength, hitting a significant psychological level.

- Immediate Resistance: ~$205 – $210

- Pivot / Control Zone: ~$195 – $200 (Current psychological barrier/pivot)

- Key Support: ~$188 – $192

What to Watch: * SOL has pushed to $200. This psychological level often acts as resistance. * For further upside, it needs a clean break and hold above $200. * A rejection from the $200-$205 area could lead to a pullback to its pivot zone of $195-$200, which would then need to hold as support. * My Bias: Observing, not trading. Its correlation to ETH and BTC will be key.

Final Thoughts: Patience Amidst the “Uptober” Buzz

Today, the crypto market has started on a positive note. ETH’s breakout above $4,080 is a key technical development, but its subsequent retest is the real moment of truth. BTC is battling strong overhead resistance.

Remember, this week holds significant macro events (FED, Core PCE). My golden rule remains: “Wait for the tremor to pass.” Trading around major announcements is often a recipe for unnecessary losses. Patience is not just a virtue; it’s a professional trading strategy. Let’s watch how these levels hold up as the week progresses.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/