Hallo zusammen!

It’s an interesting Friday, without a doubt. The market is “verdecito” (greenish) this morning, with an optimistic tone that’s always nice to see. Bitcoin, Ethereum, and Solana are all showing some strength.

However—and this is where I urge maximum caution—this isn’t just any Friday. This morning’s optimism feels more like the market holding its breath before a major event, because today, the delayed U.S. Consumer Price Index (CPI) is finally being released.

As we know, inflation data is, by far, one of the biggest market drivers right now. This is a high-impact, “trigger” event. The real direction for today (and perhaps for the next week) won’t be decided by this morning’s impulse, but by the reaction we see after the CPI data drops.

The Macro Picture: All Eyes on Inflation

Today’s macro picture is simple: it’s all about the U.S. CPI.

- Why It Matters So Much: This delayed inflation report is our clearest look at whether the Federal Reserve has any reason to change its tune.

- A “hot” number (inflation higher than expected) could spook the markets, wiping out today’s gains and reinforcing the “higher for longer” narrative.

- A “cool” number (inflation lower than expected) could be the fuel the market needs for a “risk-on” rally, validating today’s optimism.

- Europe & Other Markets: Every other piece of data on the calendar today is secondary. The U.S. CPI will dictate global sentiment.

My Operational Conclusion: Any trade before this report is pure speculation on the outcome. The real, more reliable move will come after the market digests the news.

Technical Analysis: Setting Our Levels Before the News (30-Min Charts)

With the current prices, our technical levels have shifted. Let’s establish our new map before the volatility hits, so we know which zones to watch.

(Current reference prices: BTC ~$111,200, ETH ~$3,962, SOL ~$191.90. Remember, these are observations, not predictions or recommendations.)

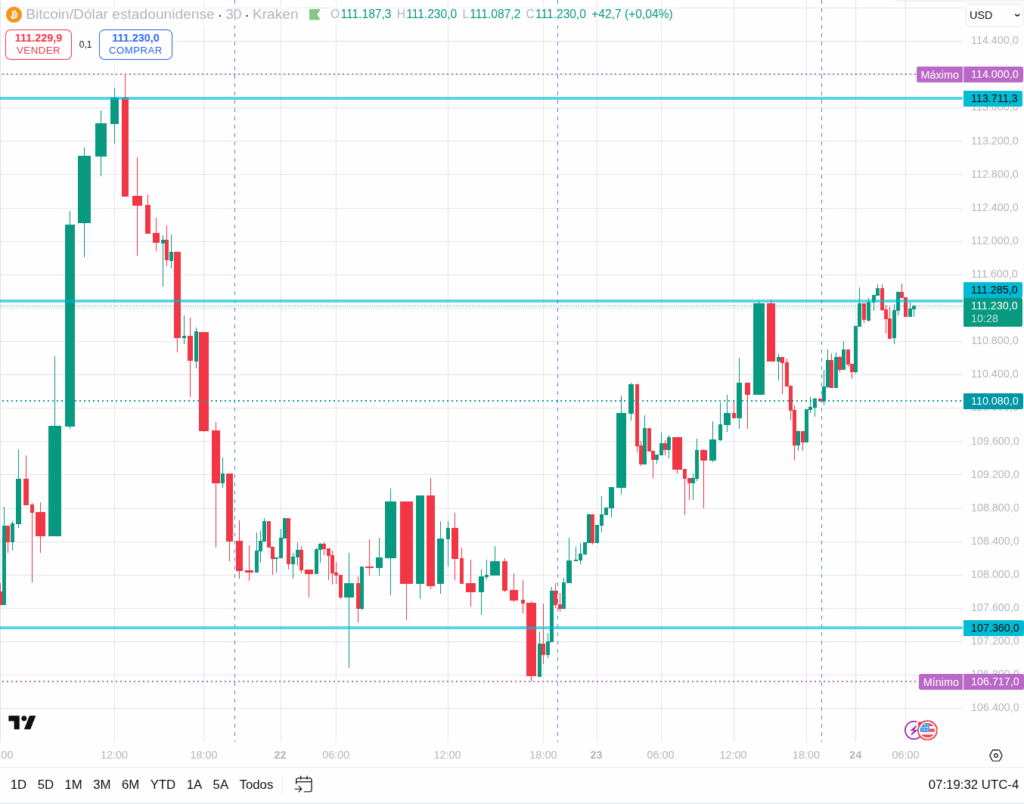

BTCUSDT (30 min)

Bitcoin, now at $111,200, has reclaimed ground and is in a key decision zone right before the data release.

- Immediate Resistance: ~$112,500 – $113,500

- Pivot / Control Zone: ~$110,800 – $111,800 (This is the current battleground)

- Key Support: ~$109,000 – $110,000

What to Watch: * BTC is consolidating just above $111k. The CPI will be the catalyst.

- A bullish reaction will look to break the **$112,500** resistance zone with force. * A bearish reaction will break the current pivot and seek the key support at $109,000-$110,000. * My Bias: Waiting. Not assuming a direction until the CPI is out and the price confirms a break or rejection of these levels.

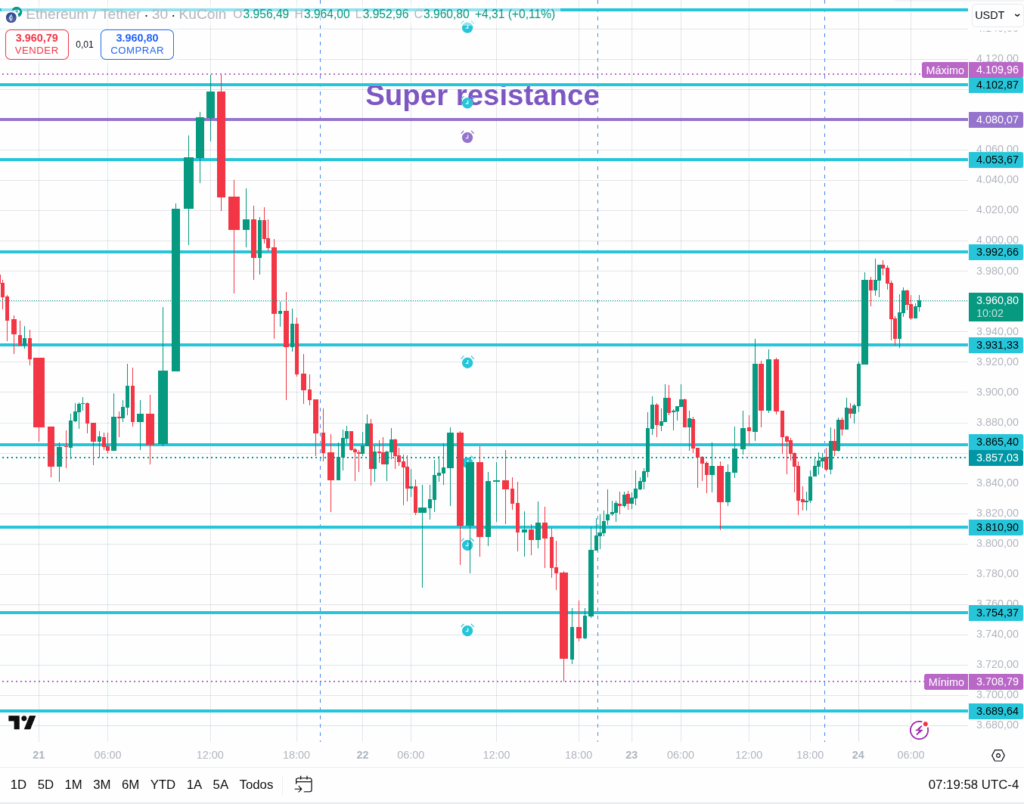

ETHUSDT (30 min)

Ethereum, at $3,962, is looking technically stronger, pushing dangerously close to the “super-resistance” we’ve been discussing.

- Immediate Resistance (Super-Resistance Zone): ~$4,000 – $4,080

- Pivot / Control Zone: ~$3,920 – $3,970

- Key Support: ~$3,800 – $3,850

What to Watch: * ETH is right on the edge. The CPI will likely be the event that determines if it can finally break the $4,000-$4,080 zone or if it gets rejected hard. * This is the most interesting pair to watch during the announcement. A clean break above would be very bullish. A strong rejection here could be very bearish. * My Bias: Prepared for an explosive reaction. This is the clearest decision point in the market right now.

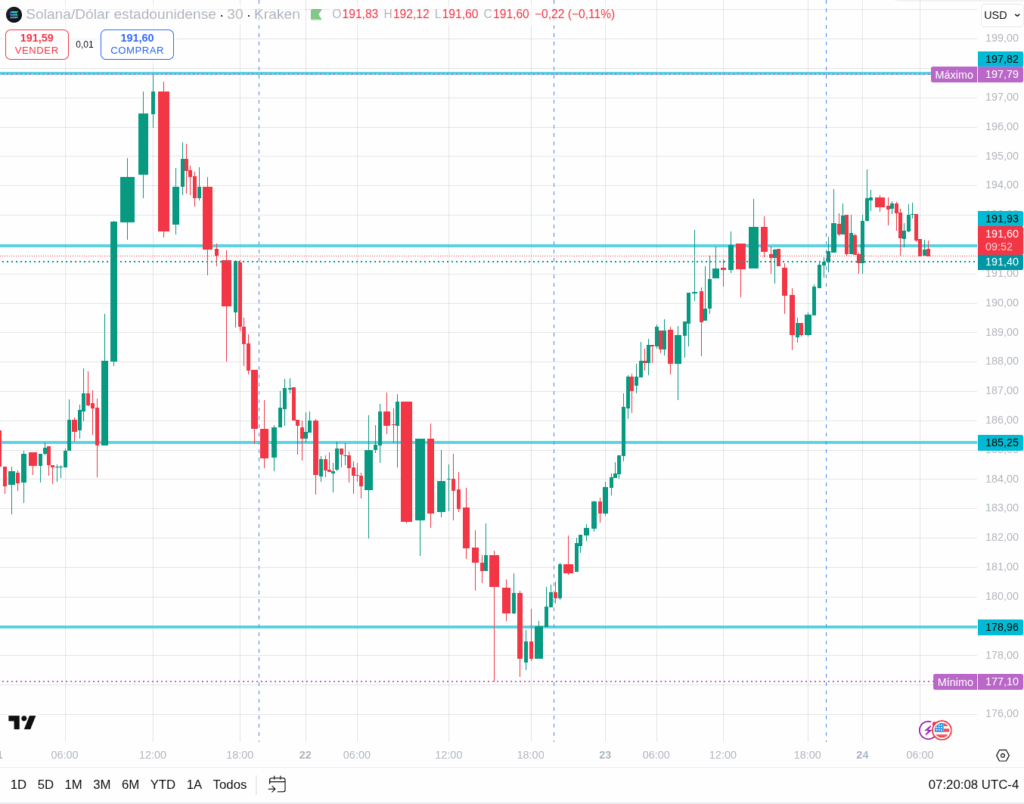

SOLUSDT (30 min)

Solana, at $191.90, has also enjoyed the morning rally and is approaching a psychological resistance.

- Immediate Resistance: ~$195 – $200 (Psychological Resistance)

- Pivot / Control Zone: ~$189 – $193

- Key Support: ~$184 – $188

What to Watch: * SOL also looks strong, trading above $190.

- The $195-$200 zone is the next major hurdle. The CPI will determine if it has the fuel to break it.

- A negative reaction to the CPI will likely send it back to test the **$184-$188** support. * My Bias: More conservative than ETH. Waiting for the CPI reaction to see if it can hold momentum above the pivot.

Final Thoughts: Don’t Trade the Anticipation

Today is all about the U.S. CPI. The market is green in anticipation, but the reaction is the only thing that matters.

Ethereum is the strongest technically, poised right below a major resistance. Bitcoin and Solana are in consolidation zones, awaiting the trigger.

My advice for today is patience. Let the dust settle after the CPI release. Don’t get caught in the initial “whipsaw” that often happens in the first few minutes. As always, manage your risk and wait for confirmation.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/