Hallo zusammen!

Today, I want to start by highlighting someone I deeply respect in the crypto analysis space: Benjamin Cowen. I rarely follow many analysts on YouTube – most tend to parrot opinions, and frankly, lack the years of dedicated, day-in-and-day-out chart observation required to truly understand these markets. But Benjamin is different.

He shares an opinion that resonates deeply with me, and with many others who’ve spent significant time in this arena: the Bitcoin bull cycle is indeed approaching its end. He suggests that next year, we’ll likely witness a “smoothed” price correction.

Benjamin eloquently points out the stance of countless market participants, an argument I’ve heard so often it almost signals the inevitable recognition of a bear market: “This time is different.” This is the rallying cry not just of eternal optimists, but of newcomers who haven’t yet experienced the market’s unforgiving cycles.

The truth is, Cowen is right. Neither he, nor I, nor anyone else has a crystal ball to predict Bitcoin’s exact future price, or precisely how far this impulse can extend. But what is certain is that the market is fractal; patterns repeat again and again, and this time will not be different.

Another very personal thought: many compare the impulses of current cycles to Bitcoin’s early days, which yielded incredible 100x+ gains. The reality is, this time, the power truly lies with institutions, with the “smart money.” To think that this cycle will see prices reach $270,000, as some indicators like the Rainbow Chart might suggest, is simply unrealistic. However, a correction at some point is as sure as death or taxes, as Benjamin Franklin so aptly put it.

Today, the market wakes up with the same optimism as previous days this week – beautiful green colors, especially for Solana. This surge in SOL might be due to the recent news of Uniswap’s integration with the token. But as I always say, nothing truly matters until the American market opens. That’s when the crypto market truly gets its direction, especially when it moves without substantial fundamental motives, driven instead by over-leveraging and high-frequency trading.

For more in-depth insights into this perspective, I highly recommend watching Benjamin Cowen’s latest video: https://www.youtube.com/watch?v=s_SJS5EdwP8&t=5s

The Macro Landscape: Technical Vigilance Amidst Shutdown Uncertainty

Today, October 23, 2025, the macroeconomic calendar remains quiet.

- U.S. Data: While Existing Home Sales are on the schedule for today, this data point typically has a moderate, rather than high-impact, effect on short-term market movements.

- Europe: No major indicators (like ECB rate decisions or key inflation/GDP reports) are scheduled.

- Persistent Shutdown: The ongoing U.S. federal government shutdown continues to affect data publications, maintaining a subtle but real layer of uncertainty across all markets.

Operational Implication: Without a major macro catalyst, market action will be more heavily influenced by sentiment, momentum flows, sector-specific news (especially in tech), and technical reactions. For us, this means maintaining moderate positions, managing liquidity, and focusing on technical breakouts, unusual volumes, or specific crypto-related news rather than expecting a “macro shock.”

Technical Analysis: Waiting for Confirmation (30-Min Charts from Binance)

Let’s look at the charts, keeping in mind the volatility of yesterday, the current optimism, and the long-term perspective.

(Current reference prices: BTC ~$109,250, ETH ~$3,864, SOL ~$187.90. Remember, these are observations, not predictions or recommendations.)

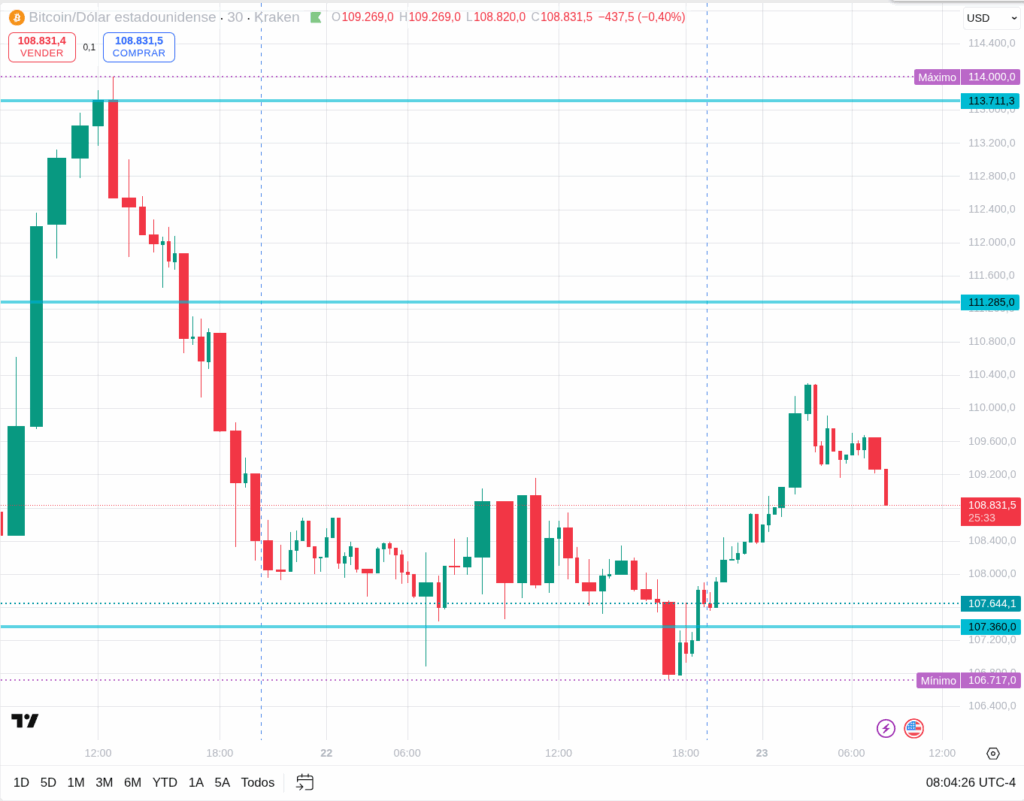

BTCUSDT (30 min)

Bitcoin, currently around $109,250, is attempting to push higher, but facing immediate resistance.

- Immediate Resistance: ~$110,000 – $111,500

- Pivot / Control Zone: ~$108,500 – $109,500

- Key Support: ~$106,500 – $108,000

What to Watch: * BTC needs a clean, high-volume close above $109,500 and then a challenge of the $110,000-$111,500 resistance zone to show sustained strength. * If price is rejected from the $109,500-$110,000 area, it suggests sellers are still present, limiting upside. * On the downside, a decisive break and close below $108,500 could open the path towards the $106,500-$108,000 support area.

Indicators: RSI (30m) is likely in a neutral-to-positive zone. MACD needs to show a clear bullish cross and sustain it to confirm momentum.

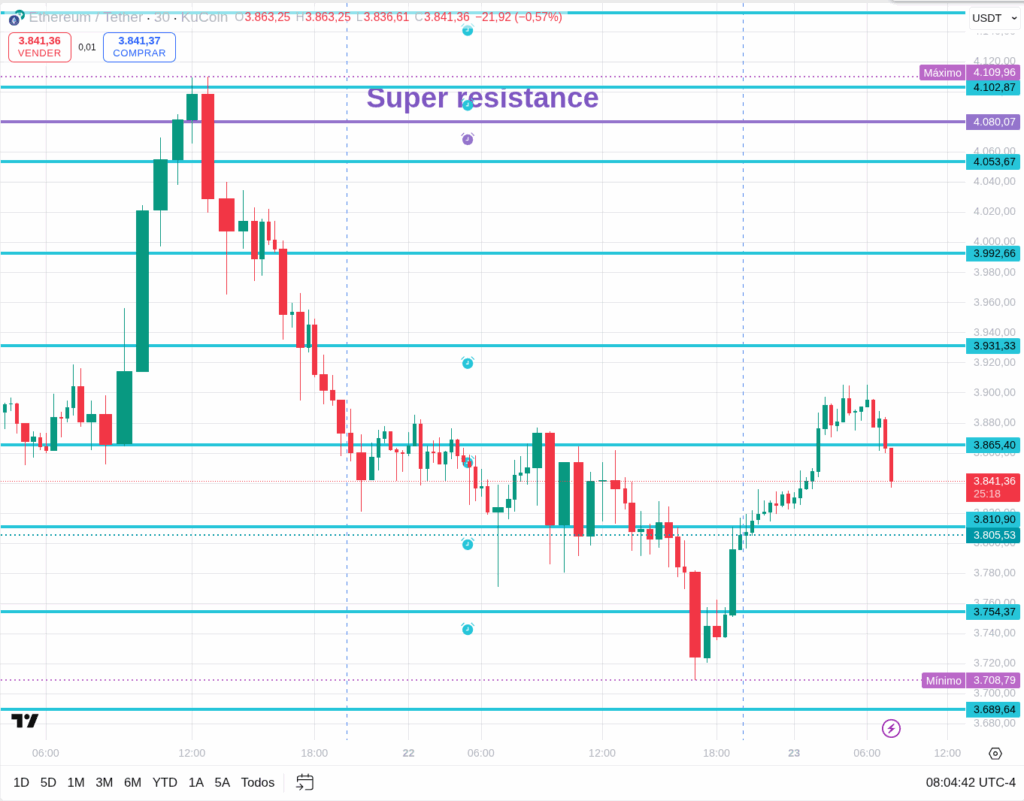

ETHUSDT (30 min)

Ethereum, trading around $3,864, is back near the crucial support zone we discussed yesterday, hovering above the H&S target.

- Immediate Resistance (Former Neckline Area): ~$3,900 – $3,950

- Pivot / Control Zone: ~$3,850 – $3,880 (current battleground)

- Key Support / H&S Target Zone: ~$3,750 – $3,780 (where the H&S pattern projects $3,760)

What to Watch: * ETH is trying to hold the $3,850-$3,880 pivot zone. Reclaiming the $3,900 level with conviction is critical to negate immediate bearish pressure. * The Head & Shoulders pattern remains a live threat. A decisive break and close below $3,850 with volume would likely lead to a test of the $3,750-$3,780 zone, confirming the H&S downside. * Rejection from the $3,900-$3,950 area (former neckline) would reinforce the bearish outlook.

Indicators: RSI (30m) will likely be near neutral-to-bearish. MACD is crucial here for confirming momentum – a sustained negative divergence or strong cross below zero would add confluence.

SOLUSDT (30 min)

Solana, currently around $187.90, is showing strength today, potentially driven by the Uniswap news.

- Immediate Resistance: ~$190 – $195

- Pivot / Control Zone: ~$186 – $189

- Key Support: ~$180 – $184

What to Watch: * SOL is currently pushing against its pivot. For a sustained move higher, a convincing close above $189 and then a challenge of the $190-$195 resistance zone is needed. * Rejection (long upper wicks) near $190-$195 would suggest sellers are defending this area, potentially leading to profit-taking after the Uniswap news. * A break and close below $186 with volume could lead to a test of the $180-$184 support.

Indicators: RSI (30m) is likely showing strength, possibly nearing overbought if the momentum continues. MACD needs to show a strong bullish cross.

Final Thoughts: The American Market & Fractals

Today, despite the initial green, the underlying message remains: “This time is not different.” The market is fractal. Benjamin Franklin’s wisdom applies as much to markets as to life. We’re in a phase where institutional power dictates more realistic gains, and a correction is inevitable.

Watch the American market open closely today. For SOL, the Uniswap news provides a narrative, but sustained price action and volume are needed. For BTC and ETH, navigate with caution, respecting the technical levels and the wisdom that true market direction often needs a solid foundation, not just a burst of “hopium.”

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/