Hello everyone.

Today, I want to start with a more personal, somber thought. I’m looking at the monthly charts, and with a heavy heart for the crypto market, it truly feels like the bullish impulse has finally come to an end.

It brings to mind a lesson from a mentor of mine. He used to say that healthy markets are like a living organism; they need to inhale and exhale. And as the old saying goes, “what goes up, must come down.” Yes, that even applies to our beloved Bitcoin.

In the financial world today, we are bombarded by people trying to manipulate others, instilling that infamous “FOMO” with grand promises of assets “going parabolic.” But that’s rarely the truth. It reminds me of a powerful analogy I read in a book by Oliver Velez, which he called the “Orchestra Wagon.”

Imagine a train pulling into a station. In the beginning, the “big money,” the smart capital, quietly gets on board. They set up an orchestra, and joyful music begins to play. As the train starts moving, they throw a huge party and invite everyone to join. The music gets louder, the party gets wilder, and more and more people, hearing the celebration, scramble to get on the train, afraid of missing out.

But here’s the crucial part: while the party is raging and the new guests are distracted, the original hosts—the big money—begin to quietly slip out the back, unnoticed. And just when the party is at its peak, the music stops, the train starts to shake violently, and all the unsuspecting guests are thrown off, one by one, left to suffer the consequences. And then, once the train is empty, the cycle begins all over again.

I’m not saying it’s an absolute certainty that the market will crash from here. But this is the pattern that has played out time and time again. The more you deny it, the worse it will be for you.

With that sobering thought in mind, let’s ground ourselves in the facts of today’s market.

But let me add a crucial point: just because the market might be pulling back, doesn’t mean it’s “bad.” Quite the opposite! A healthy correction, a significant retracement, actually demonstrates how strong an asset truly is in the long run. It shakes out the weak hands, allows for price discovery at more sustainable levels, and most importantly, generates new opportunities for those with capital, patience, and a long-term vision. This is the natural rhythm of robust markets, not a sign of failure. It’s simply the exhale before the next inhale.

The Macro Environment: Inflation Clues Amidst the Data Void

While we ponder these long-term cycles, the immediate focus today is on U.S. economic data.

- The Main Event: Producer Price Index (PPI): With the key CPI (consumer inflation) report still delayed by the government shutdown, today’s PPI at 8:30 AM ET becomes the most important inflation proxy. It gives us a look at wholesale prices and can signal what’s coming down the pipeline for consumers.

- Other Key Data: We’ll also see reports on Housing Starts, Building Permits, and Industrial Production. These will help paint a picture of the U.S. economy’s health.

The key takeaway is that in this information vacuum created by the shutdown, any piece of data that is released will be scrutinized intensely. A surprise in the PPI, for instance, could cause significant volatility in equities, which would undoubtedly spill over into crypto. Fed speeches throughout the week will also continue to be major wildcards.

My Personal Market Read: The Flight to Safety is Real, and Opportunities are Brewing

As we discussed yesterday, Gold and Silver have already broken their All-Time Highs. This isn’t just a coincidence; it’s a clear signal that smart money is actively seeking shelter. They are getting off the “Orchestra Wagon” of risk assets and moving into safe havens.

This reinforces my view that in times of fear, cryptocurrencies are still perceived by the broader market as very high-risk assets. Despite the “digital gold” narrative, Bitcoin’s historical correlation with the tech-heavy Nasdaq is hard to ignore. When the party music stops in the traditional markets, crypto is often one of the first to feel the silence.

The question isn’t if a correction will happen, but how deep it will be. However, for those with a strategic mindset, a significant pullback is not a reason to despair. It’s a chance to reassess, find undervalued assets, and position for the next cycle. These are the moments when fortunes are made by patiently accumulating while others are panicking.

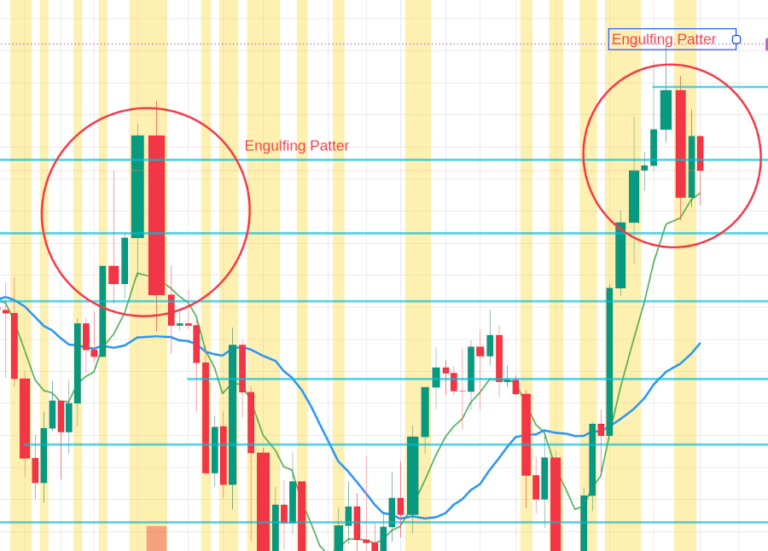

Technical Analysis: The Battle Lines Are Drawn (30-Min Charts)

Let’s look at the immediate technical levels on the 30-minute charts to see where the key battles are being fought, based on the current prices I’ve just pulled from Binance.

(Current reference prices: BTC ~$104,800, ETH ~$3,750, SOL ~$178. Remember, these are observations, not predictions or recommendations.)

BTCUSDT (30 min)

With the price now around $104,800, the market structure has shifted significantly lower, testing critical support.

- The Ceiling (Immediate Resistance): ~$106,500 – $108,000

- The Battleground (Pivot Zone): ~$103,500 – $105,000

- The Floor (Key Support): ~$101,000 – $102,500

What to Watch:

- For any bullish hope, buyers need to reclaim the $105,000 pivot zone and then challenge the $106,500 resistance with significant volume.

- A “false breakout” where price spikes into the pivot zone only to be rejected back down would be an extremely bearish continuation signal.

- A decisive break and close below the $103,500 level would likely act as the trigger for the next leg down, targeting the key support area around $101,000.

ETHUSDT (30 min)

Trading at $3,750, Ethereum is also showing considerable weakness, barely holding onto psychological levels.

- The Ceiling (Immediate Resistance): ~$3,850 – $3,950

- The Battleground (Pivot Zone): ~$3,700 – $3,800

- The Floor (Key Support): ~$3,500 – $3,600

What to Watch:

- Bulls need to push the price firmly back above $3,800 to show any sign of life.

- Visible rejection with long upper wicks in the $3,850-$3,950 resistance zone would confirm that sellers remain in firm control.

- A break below the immediate support of $3,700 with force could open the door to a test of the major $3,500-$3,600 support level.

SOLUSDT (30 min)

At $178, Solana has experienced a sharp pullback and is now at a critical juncture, testing its recent lows.

- The Ceiling (Immediate Resistance): ~$185 – $195

- The Battleground (Pivot Zone): ~$170 – $180

- The Floor (Key Support): ~$145 – $155

What to Watch:

- A convincing close back above $180 and then a challenge of the $185 resistance is needed for any bullish case.

- Strong rejections (long upper wicks) anywhere in the current $170-$180 pivot zone would suggest that sellers still dominate.

- A volume-backed break below $170 could trigger a significant drop towards the major support zone around $145-$155.

Final Thoughts: The Music is Fading, But the Opportunity is Emerging

The macro environment is uncertain, and the technical picture is fragile. The flight to traditional safe havens is a clear warning sign. It truly feels like the music from the “Orchestra Wagon” is fading.

However, this is not a time for despair, but for strategic thinking. A market correction is a natural, healthy process that cleanses the system and creates immense opportunities for those prepared to take them.

My approach today is one of extreme caution for active trading, but with an eye on the bigger picture for long-term accumulation. Prioritize capital preservation, wait for high-conviction setups confirmed by both price action and volume, and respect your risk management rules above all else. Don’t be the last one at the party, but be ready for the next one.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/