Good morning, everyone! As we step into mid-week, the financial markets are buzzing with a palpable sense of anticipation. After the volatility we’ve seen, today promises to be a pivotal day with key economic data and central bank commentary on the horizon.

Yesterday, we discussed the wild swings and the need for caution. Today, that caution is compounded by a larger question that many of you, my valued readers, are asking: What will happen to Bitcoin if we truly enter a bear market? This is especially pertinent when we consider what’s happening in safe-haven assets.

Let’s dive into the macro picture, then tackle this crucial question head-on, because as professional traders, we must look at the market with the eyes of reality, not with the eyes of what we wish to see.

The Macro Picture: Data-Rich Day Ahead

🇺🇸 U.S.: Inflation, Spending, and Fed Insights

Today is a much busier day on the U.S. economic calendar, bringing several potential market movers:

- Retail Sales (September) & PPI / Core PPI (September): These are the headline acts. We’re expecting a slight deceleration in retail sales and a moderation in producer prices. Any significant deviation from these forecasts could trigger immediate reactions across equities and beyond, as they feed directly into inflation and consumer demand narratives.

- The Fed’s Beige Book: This qualitative report, offering anecdotal insights into regional economic activity, will be closely scrutinized. It provides a “boots on the ground” perspective that official statistics often miss, and could offer nuanced clues about the Fed’s future policy stance.

- Fed Officials’ Speeches: Several Federal Reserve officials, including Waller, Barkin, and Barr, are scheduled to speak. Their comments on inflation, growth, and monetary policy could inject further volatility and provide directional bias to the markets.

All of this unfolds against the backdrop of the lingering government shutdown, which, while not as acutely impacting today’s scheduled data releases, still adds a layer of uncertainty and heightens market sensitivity.

🇪🇺 Europe: Economic Sentiment and Unemployment

Across the Atlantic, the Eurozone is releasing its Economic Sentiment for October and Unemployment Rate for September. While not typically as market-moving as U.S. inflation data, these figures offer a snapshot of economic health and confidence in the region. European markets will, as usual, also be heavily influenced by the developments coming out of the U.S.

Crypto’s Connection: The crypto market, by its very nature, is a high-beta asset class. This means it tends to amplify movements in traditional risk markets. If today’s U.S. data surprises and fuels either a strong “risk-on” or “risk-off” sentiment, Bitcoin, Ethereum, and Solana will likely see significant action. Unexpected comments from central bankers or regulatory news could also spark rapid, sharp movements.

Today’s Macro Conclusion: With a dense economic calendar and Fed commentary, today promises to be a day of high potential volatility. Every data point and every word from a Fed official will be dissected.

My Personal Market Read: The Safe Havens are Yelling – What About Crypto?

Here’s where things get particularly interesting, and frankly, a bit concerning.

While we talk about the macro drivers, let’s not forget what’s happening with traditional safe-haven assets: both Gold and Silver have recently surged and broken through their All-Time Highs (ATHs)! This is a powerful signal that institutional money, and indeed the broader market, is seeking shelter from economic uncertainty and inflationary pressures.

Now, this brings us to the core question: What happens to Bitcoin if we truly enter a bear market?

Bitcoin is often championed as “digital gold,” a powerful store of value, and an asset that some believe could even surpass gold in significance. And I share a certain admiration for this perspective – the technological innovation and potential scarcity are undeniable.

However, we must confront reality. For the vast majority of the traditional financial market, cryptocurrencies, including Bitcoin, are still categorized as assets of very high risk. When fear grips the market, or when liquidity tightens, these are often the first assets to be sold off. This is precisely what we saw in response to the recent tariff news.

Historically, Bitcoin, despite its “digital gold” narrative, has often shown a strong correlation with the Nasdaq, a tech-heavy index that represents growth stocks – which are inherently riskier. This behavior, if it continues during a prolonged downturn, suggests that in a true bear market environment driven by global economic fear, Bitcoin might not act as a safe haven, but rather as a highly volatile risk asset that suffers alongside equities.

My opinion? The argument that BTC is as powerful, or even more powerful, than gold has merit in a long-term, speculative, and technological sense. But in the short-to-medium term, during periods of significant market stress, the market’s perception of BTC as a risk-on asset tends to dominate. I believe it’s crucial to acknowledge this historical correlation with the Nasdaq and the current flight to traditional safe havens. This doesn’t mean BTC has no future as a store of value, but it does mean we need to temper expectations during a potential bear market. We must observe what the market does, not what we hope it will do.

Technical Analysis: Crucial Levels Under Scrutiny (30-Min Charts)

With today’s packed agenda and the underlying market sentiment, precise technical analysis is more critical than ever.

(Current BTC reference price: ~$111,446 USD. Remember, these are observations, not predictions or recommendations.)

BTCUSDT (30 min)

- Immediate Resistance: ~$113,500 – $115,000

- Pivot / Control Zone: ~$110,500 – $112,500

- Strong Support: ~$108,500 – $110,500

Price Action & What to Watch: * For bullish continuation, look for a strong candle close above $113,500 with clear volume and minimal upper wick. A successful retest of this level as support would be key. * Rejection (long upper wicks) at $113,500 would signal strong seller defense. * On the downside, a firm close below $110,500 with volume could open the path towards $108,500 or lower.

Indicators (30 min): * RSI: Monitor for reversals near 70 (overbought) or signs of positive divergence. * MACD: A bullish cross (MACD line above signal) supports upward momentum; a bearish cross warns of weakness. * Moving Averages (MA50 / MA200): A golden cross (MA50 above MA200) reinforces a bullish structure; a death cross signals bearish pressure.

ETHUSDT (30 min)

- Key Resistance: ~$4,000 – $4,250

- Pivot / Mid-Zone: ~$3,700 – $3,900

- Relevant Support: ~$3,400 – $3,600

Price Action & What to Watch: * A strong candle close above $4,000 without an extended upper wick would be a positive sign. A retest and hold of this level would confirm. * Visible rejection (long upper wicks) near $4,000 would indicate seller strength. * A clear break below $3,600 could lead to downside towards $3,400.

Indicators: Watch RSI near 70 for reversals. MACD crosses and divergences will provide momentum clues. MA crossovers indicate structural shifts.

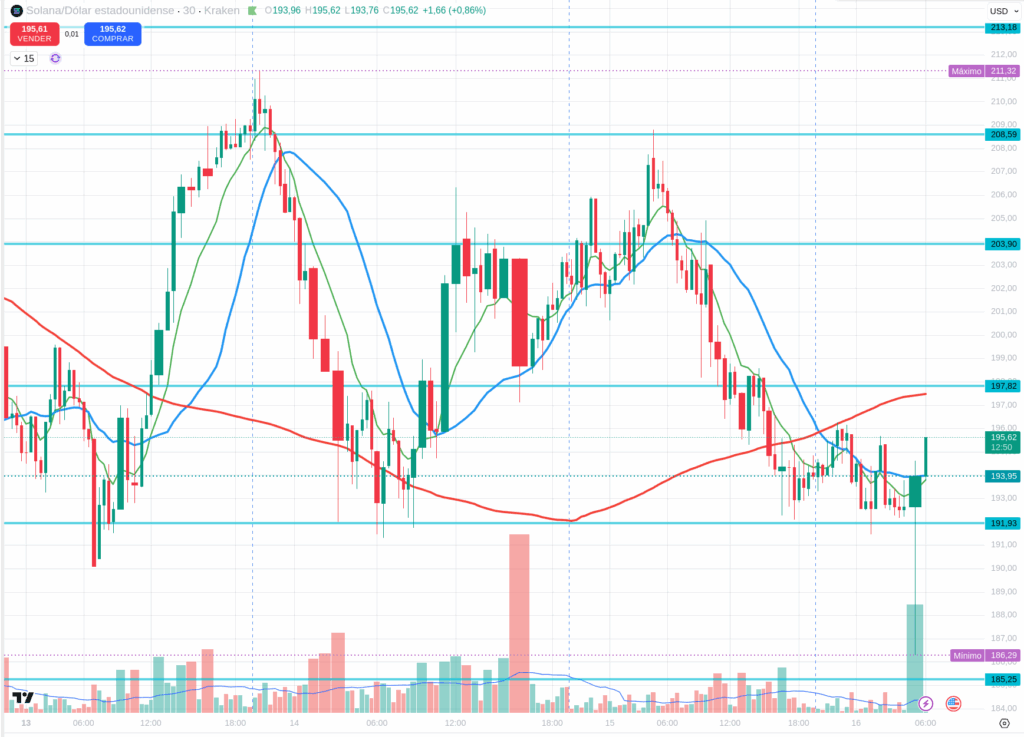

SOLUSDT (30 min)

- Probable Resistance: ~$120 – $135

- Pivot / Control Zone: ~$90 – $115

- Strong Support: ~$60 – $90

Price Action & What to Watch: * A strong candle close above $120 with little upper wick would be a bullish signal. A retest acting as support would confirm. * Rejection (long upper wicks) at $120 would suggest sellers are defending the level. * A firm close below $90 with volume could open the path to lower supports.

Indicators: RSI approaching 70 warrants vigilance for exhaustion. MACD crosses and MA crossovers will be key for momentum and structural analysis.

Final Thoughts & Professional Strategy for Today

Today is a high-stakes day, particularly for U.S. markets, with critical inflation and spending data, plus Fed commentary. The market’s reaction to these inputs will dictate global risk sentiment, which in turn will significantly impact cryptocurrencies.

- Trade with conviction, but with confirmation: Always wait for clean breakouts, successful retests, and supporting volume.

- Respect safe havens: The rally in Gold and Silver is a strong message about underlying fear.

- Acknowledge risk: Cryptocurrencies are high-risk assets. Their historical correlation with Nasdaq needs to be respected, especially if a bear market unfolds.

- Strict Risk Management: Employ tight stop-losses and measured position sizing.

Approach today with a pragmatic mindset, focusing on what the market is doing, not what you hope it will do.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/