Good morning, traders and market watchers! Hope you’re all doing well after what’s been a truly wild ride.

As I pointed out yesterday, market volatility is the name of the game right now, and boy, did we see that play out! Yesterday, for example, ETHUSDT took a steep dive of over 6%, only to claw its way back and finish down around -2%. That’s a huge swing in a single day!

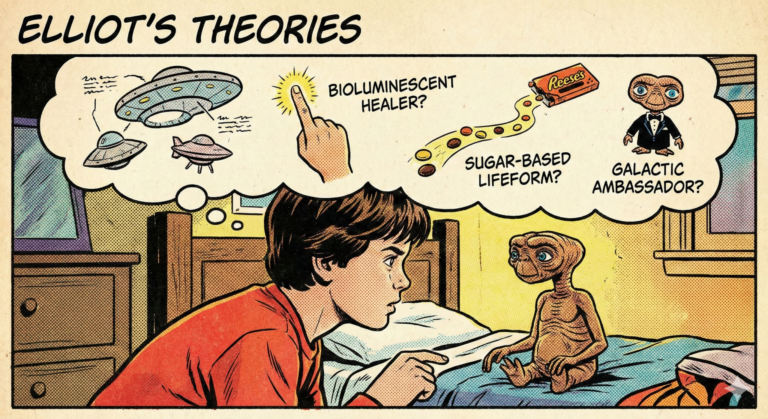

This kind of choppy action really drives home a point: if you’re trying to make swing trades right now, it feels like you’d need a crystal ball (the kind fortune tellers use!) to get it right consistently. And if you’re thinking about intraday trading on those 5-minute charts, be extra careful. You’re not just battling other human traders; you’re up against sophisticated algorithms that execute trades at speeds no human can match. It’s a tough fight!

I know that volatility often creates opportunities, but it’s equally true that it can make you give back all your profits to the market, and then some. So, please, proceed with extreme caution.

Let’s break down the current landscape and see what the charts are telling us today.

The Macro View: Waiting Game for Data

🇺🇸 U.S.: Data Delays & the Fed’s “Beige Book”

Today, the U.S. economic calendar has a few items, including the Real Earnings data for September. However, the big one—the CPI (Consumer Price Index) for September—which was expected today, has been rescheduled due to the ongoing government shutdown. This means we’re still largely flying blind on key inflation figures.

What is coming out is the Federal Reserve’s Beige Book. This report gathers anecdotal information on economic conditions from around the country. It’s not a hard data point, but it gives us a qualitative feel for how the economy is performing at a regional level. In this environment, any clues are valuable.

🇪🇺 Europe: Still Quiet

Europe continues its quiet macro trend for today. The focus remains on broader political discussions and the ongoing regulatory agenda for crypto, which continues to simmer in the background.

Connecting to Crypto: Crypto assets, as we’ve seen, remain highly sensitive to global risk sentiment. Any surprises from the Fed (even subtle ones in the Beige Book), further diplomatic talks (or lack thereof), or unexpected regulatory news could still trigger abrupt movements.

Today’s Macro Conclusion: The absence of clear, impactful macro data means the market is left to react to sentiment, news headlines, and technical levels. Expect continued sensitivity and potentially swift movements.

My Personal Market Read: Volatility is a Double-Edged Sword

My message today is one of caution and respect for the market’s current wild swings. Yes, volatility does create chances for quick profits, but it also amplifies the risks immensely. Getting caught on the wrong side of a sudden reversal, like ETH’s yesterday, can wipe out gains (or even capital) incredibly fast.

I’m keeping my focus on the bigger picture and disciplined execution. It’s a time for patience and precise entries, not aggressive overtrading.

Technical Analysis: Navigating the Swings (30-Min Charts)

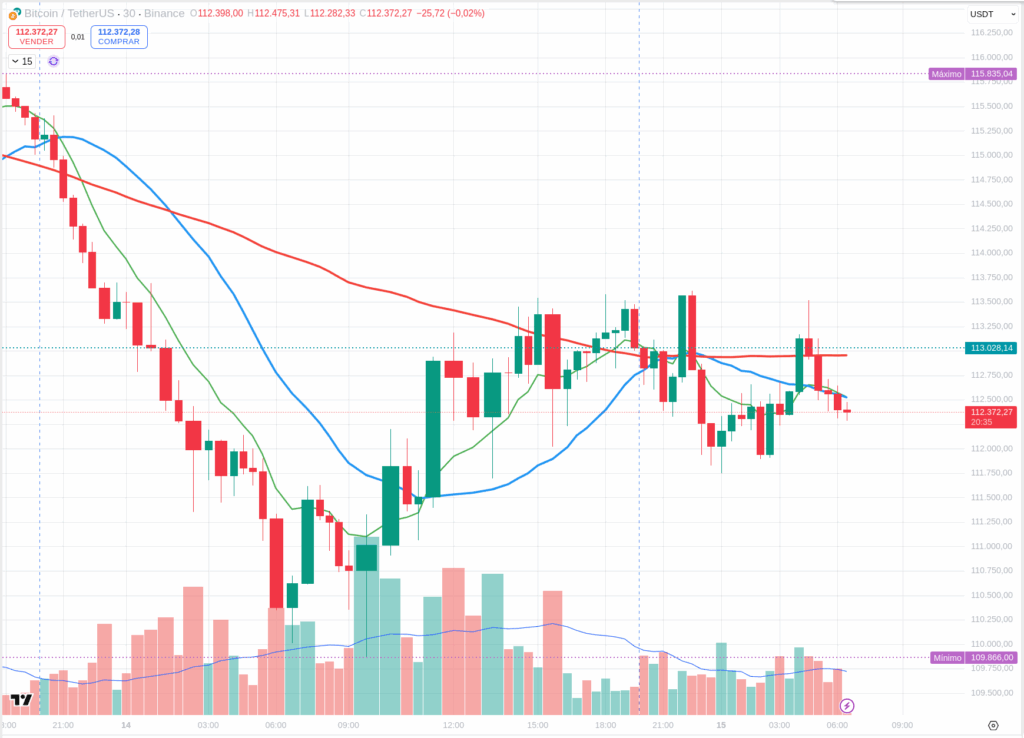

Let’s use a current BTC reference price of ~$112,088 USD for our analysis. Remember, these are immediate levels to watch on the 30-minute charts, crucial for understanding today’s fast movements.

BTCUSDT (30 min)

- Immediate Resistance: ~$113,500 – $115,000

- Pivot / Control Zone: ~$110,500 – $112,500

- Strong Support: ~$108,500 – $110,500

Price Action & What to Watch: * For a push higher, look for a strong candle close above $113,500 with good volume and little upper shadow. A successful retest of this level would be a good confirmation. * If price hits this resistance and shows long upper wicks (rejection), it signals sellers are still strong. * On the downside, a clear close below $110,500 with volume could open the path towards $108,500.

Indicators: RSI and MACD will be trying to find direction. Watch for signs of positive divergence or a MACD cross-up for bullish momentum, or the opposite for continued weakness. Moving Averages (MA50/MA200) can indicate shifts in short-term trend.

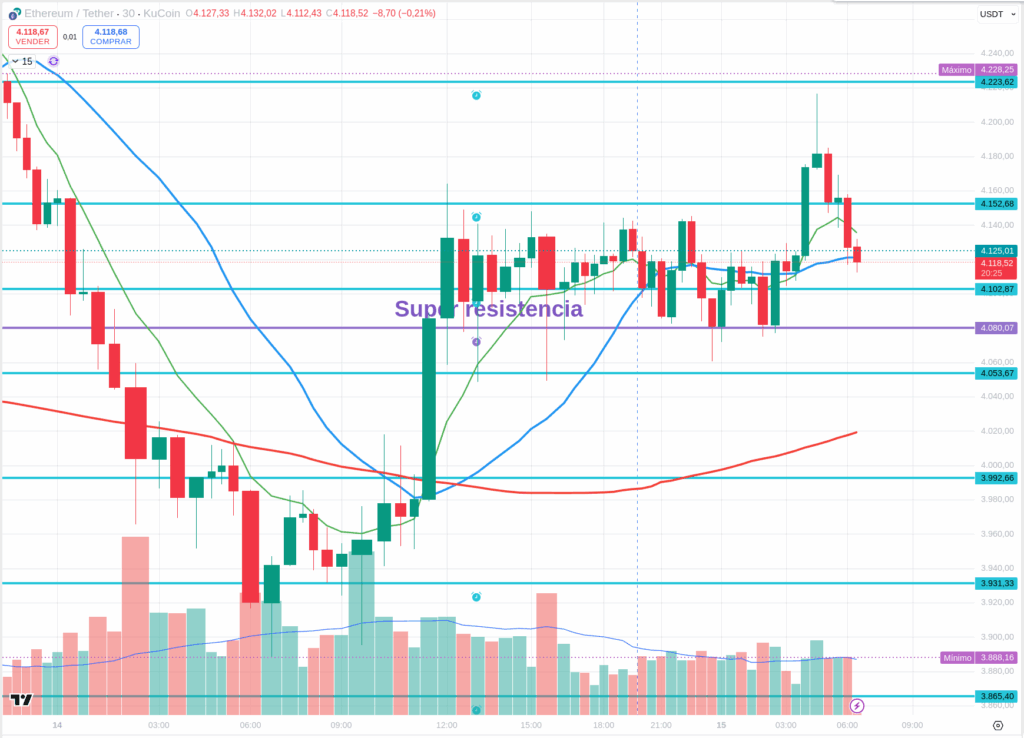

ETHUSDT (30 min)

- Immediate Resistance: ~$4,050 – $4,250

- Pivot / Mid-Zone: ~$3,700 – $3,900

- Strong Support: ~$3,400 – $3,600

Price Action & What to Watch: * A strong candle close above $4,050 with good volume would be a positive sign for buyers. * Watch for rejection at resistance (long upper wicks) signaling sellers are active. * A clear close below $3,600 could bring pressure towards $3,400.

Indicators: Monitor RSI for reversals near 70, and MACD for bullish or bearish crosses. MA crossovers will also provide trend clues.

SOLUSDT (30 min)

- Immediate Resistance: ~$120 – $135

- Pivot / Control Zone: ~$90 – $115

- Strong Support: ~$60 – $90

Price Action & What to Watch: * A clean close above $120 without large upper wicks would be a strong sign for continuation. * Rejection at $120 (long upper wicks) indicates seller presence. * A clear close below $90 with volume could lead to further downside towards $60-$80.

Indicators: RSI near 70 and MACD crosses should be monitored for signs of exhaustion or shifts in momentum. MA crossovers will also be important.

Final Thoughts & Strategy for Today

Today is another day where macro data is limited, leaving the market highly sensitive to news, sentiment, and technical levels. Given the extreme volatility we’ve seen, it’s a day for precision and strict risk management.

- Confirm, then act: Wait for clear breakouts and successful retests.

- Don’t fight the algorithms: Be aware of the speed at which intraday moves can happen.

- Prioritize price action: Indicators are helpful filters, but the raw candles tell the real story.

- Manage risk ruthlessly: Stops are your best friends in choppy markets.

Trade carefully, everyone.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/