Good morning, everyone! First and foremost, I sincerely apologize for the delay in getting yesterday’s analysis out to you. I was caught up in a crucial business meeting that ran longer than expected. Thank you so much for your understanding!

Now, let’s talk about today, because if you’ve glanced at your crypto charts this morning, you’ve likely seen a lot of red. And when I say red, I mean deep, undeniable red.

What happened? What caused this massive sell-off across the crypto market?

Looking at the 30-minute charts for BTCUSDT, ETHUSDT, and SOLUSDT on Binance, the answer lies squarely in what happened in the U.S. stock market.

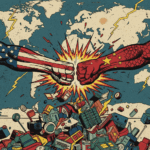

As I mentioned yesterday (if you missed it, you can catch up here: market-analysis-october-13-2025-tariffs-shock-columbus-day-calm-and-the-whispers-of-a-bear-market, the President’s announcement of new tariffs on China sent shockwaves through the traditional markets. This wasn’t just a small dip; it was a significant drop that affected everything. And let’s be honest, the U.S. market is the undeniable conductor of this global orchestra. While other markets certainly play important parts, when the U.S. moves decisively, especially on major news like tariffs, the rest of the world, including crypto, tends to follow.

This massive sell-off in traditional markets spilled over directly into crypto. It’s a classic case of “risk-off” sentiment: when the big money in traditional finance gets scared, they pull funds from riskier assets like cryptocurrencies first.

So, while we have some U.S. economic data slated for today (Retail Sales, PPI, etc.), the real story is the ripple effect from that tariff news.

The Macro Picture: Diplomacy vs. Data Void

🇺🇸 U.S.: Tariffs Fallout & Diplomatic Hopes

Today, the aftershocks of the tariff announcement are still very much in play. The U.S. market, which I consider the leading force globally (no disrespect to others, but it sets the tone!), is still digesting the implications. While some new economic data is on the calendar for today (Retail Sales, PPI, Philadelphia Fed Index, Business Inventories), the ongoing government shutdown means their impact might be muted. It’s tough to trust data when the source is compromised.

However, there’s a small glimmer of hope on the diplomatic front: whispers of a potential meeting between President Trump and President Xi Jinping. If these trade tensions can ease, it would be a huge positive for risk assets globally. But for now, it’s just a whisper.

🇪🇺 Europe: Quiet on the Macro Front

Europe remains relatively calm on the immediate macro data front. Their focus continues to be on long-term regulatory discussions, especially concerning stablecoins, reflecting crypto’s growing importance in their policy agenda.

Today’s Macro Conclusion: The massive crypto sell-off is a direct consequence of the tariff news hitting global markets. Today, traditional markets are reacting to that, and crypto is following suit. Any positive news on trade diplomacy could provide a temporary lift, but the fundamental selling pressure from the tariff shock is real.

My Personal Market Read: Observing the Chaos from Afar

Today, my trading philosophy is simple: I prefer to observe the bulls (and bears!) from a safe distance. This market is extremely red, and while it’s tempting to jump in, my experience tells me that these sharp, sudden drops, especially when caused by unexpected fundamental events like tariff announcements, often lead to a “natural rebound.” It’s like a stretched rubber band snapping back, but that doesn’t mean the long-term trend has changed.

This rebound, if it comes, is purely a reaction to the initial shock, not necessarily a sign of underlying strength. In my gut, I still feel we could be on the verge of a bear market. The combination of ETH’s repeated rejections at its ATH, BTC’s weary rally, and now these significant geopolitical headwinds (plus the historical context of what happens when the Fed cuts rates, which we discussed yesterday) makes me incredibly cautious.

As traders, we must view the market with the eyes of reality, not with the eyes of what we want to see. Today, reality is telling me to be patient.

Technical Analysis: Under Heavy Pressure (30-Min Charts)

Let’s look at the immediate technical levels for BTC, ETH, and SOL on the 30-minute charts, keeping in mind the current selling pressure.

(Current BTC reference price: ~$113,604 USD. These are observations, not predictions or recommendations.)

BTCUSDT (30 min)

- Resistance to Watch: ~$115,500 – $116,800

- Pivot / Control Zone: ~$112,500 – $114,500

- Key Support: ~$110,000 – $112,000

What to Look For (Price Action): * If buyers gain control, look for a strong candle close above $115,500. * Watch for long upper wicks near resistance – that’s sellers pushing back. * On the downside, a firm close below $112,000-$112,500 could open the door to $110,000.

Indicators: Currently, indicators like RSI and MACD are likely reflecting the sell-off. We need to see them stabilize or show positive divergence for any sustained bounce.

ETHUSDT (30 min)

- Resistance to Watch: ~$4,100 – $4,300

- Pivot / Mid-Zone: ~$3,800 – $4,000

- Key Support: ~$3,400 – $3,650

What to Look For (Price Action): * A strong candle close above $4,100 would suggest buyers are attempting to regain ground. * Rejection with long upper wicks at resistance would confirm seller presence. * A close below $3,650 could accelerate the move towards $3,400.

Indicators: Similar to BTC, indicators will show bearish sentiment. We need to see them turn around to confirm a bounce.

SOLUSDT (30 min)

- Resistance to Watch: ~$120 – $135

- Pivot / Control Zone: ~$90 – $115

- Key Support: ~$60 – $85

What to Look For (Price Action): * A convincing close above $120 would be a positive sign. * Long upper wicks near resistance would imply strong seller defense. * A close below $85-$90 could trigger further downside towards $60-$80.

Indicators: Indicators will be in bearish territory. Look for divergence or strong momentum shifts for any reversal signals.

Final Thoughts & Strategy for Today

Today is about extreme vigilance and prudence. The initial sell-off was a direct consequence of unexpected, negative macro news. While a technical bounce is possible, my personal bias remains highly cautious, seeing this as a potential precursor to a bear market.

Stick to your disciplined trading rules:

- Confirm, don’t anticipate: Wait for clear breakouts and successful retests.

- Filters, not triggers: Use indicators (RSI, MACD, MAs) to support, not replace, price action.

- Risk Management: Always have your stop-losses in place and manage your position sizing.

Keep an eye on any further news regarding U.S.-China trade relations – that’s the ultimate wild card today.

Disclaimer: This content is for informational purposes only and represents personal observations and technical analysis. It does not constitute financial, investment, or trading advice. Please conduct your own research and consult a professional before making any financial decisions. For our full statement, please read our disclaimer here: https://tavoplus.com/disclaimer/